Thanks to getting an annual bonus for 2015 that finally hit my account (yay!) and a paycheck, I have paid off the last $200 of my credit card debt and have started savings funds!

I suppose I am now officially ‘Single Debt Single Woman’! 🙂 Woot!

“It’s Deja-vu all over again…”

Last year (2015) this time, around the end of February / early March, I had just paid off over $30,000 of credit card debt. I celebrated and was happy to be reaching large debt milestones. I even had about $2,000 in savings at the time. Things were looking up. Next on the horizon was my student loan debt. Just days after writing those posts, I ended up in the emergency room, and several expensive doctors visits, diagnostic tests, and one major surgery later, I ended up losing all of 2015 to paying off the incurred medical expenses.

Well, here I am again at the end of February (2016) with my credit card debt freshly paid off and a bit of money in savings. I had been looking forward to an uneventful 2016, but as I mentioned in my previous post, I’m now I’m dealing with stress and uncertainty at work and home this year. It may be superstition, but I worry a tiny bit that something else is going to go wrong now that I’m out of credit card debt again.

Work Update:

The aforementioned co-worker finally kicked into gear and produced something usable for my project . I will have to make do with it. It appears that we will both keep our jobs, not that I really thought anything as serious as job loss could happen, but it’s one more spur under my office chair that’s making me less comfortable there. I’m glancing at the job boards more frequently, but I’ll only leave for something really worthwhile.

So how are things looking for me now (financially)?

Credit Card Debt is Gone!

I finally paid off the last $200. The $30,000+ balance is gone… for the second time!

.

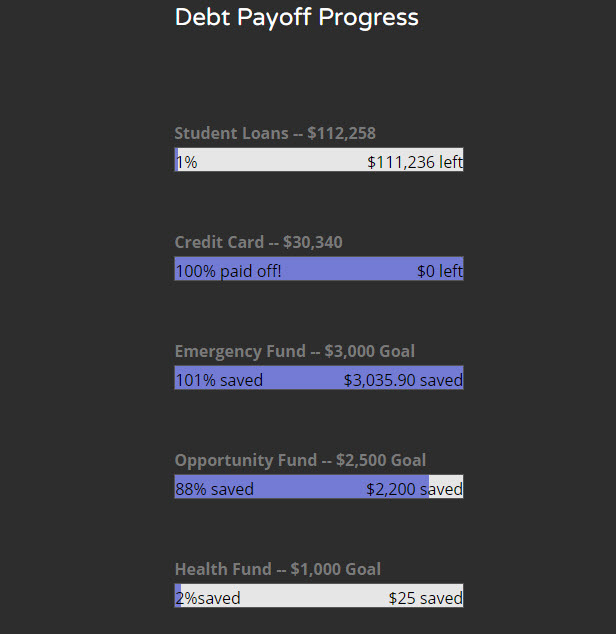

‘Minor’ Emergency Fund is Funded!

Credit to Scott Alan Turner for introducing me to this emergency fund calculator. Based on what I told it about my income and expenses, it recommended three levels of savings. I have my ‘minor’ fund, funded already and I will increase my emergency fund to the ‘major’ level over time by contributing $50/mo.

.

Opportunity Fund for 2016 is almost Funded!

Thanks also to Scott Alan Turner for the term Opportunity Fund. In 2016, my opportunity fund will cover a 12-year overdue international trip, a domestic trip to visit my family for the holidays in December, and any other worthwhile activity or item worth saving up for. The budget for this fund may adjust during the year. In any event, I’ll be contributing $50 per month toward this fund. I currently have $2,200 saved, but aim for at least $2,500.

.

Health Fund for 2016?

I’m considering adding a Health/Medical fund to this list. I had multiple diagnostic scans had last year and was incidentally diagnosed with two other health issues that are not life threatening, but will need to be monitored as they could, if left alone over the years, develop life threatening complications. One of them I mentioned before. The other one is a known health issue that runs in my family so I was not surprised to hear that I was developing it.

Long story short, I will need periodic monitoring to make sure that everything is relatively fine. I’m thinking of setting aside a certain amount, maybe $1000, to cover these needs. This could include anything from additional testing, visits to a medical doctor / naturopath, and dietary supplements, to even a gym membership. I don’t want my laser focus on attacking this student loan debt to make me put off getting needed medical attention. The more I think about it, the more I like this idea… I’m going to add it to my list of funds. I will leave my HSA funds in reserve to cover any sudden serious illness / accident.

.

.

…On the Horizon…

After I finish building up my savings funds, I will turn my attention and both barrels toward the massive student loan debt that is between me and freedom! Watch out!

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)

Thank you for a detailed update and many congratulations on again erasing the credit card debt, hopefully for good, It’s always easier to fight a war on just one front. I hope you’ll get a good run now and surge ahead.

Would you ever do an extra, part time job to help push it along or is that a non-starter?

Good luck for the months ahead and thanks again for the post.

Paul.

LikeLike

In my previous post I wrote about that possibility as well as my concerns given what happened to me the last time I took up a second job. I’m still considering it, but cautiously. Thanks for the encouragement!

LikeLike

Look at what you have achieved all that hard work has paid off!!

LikeLike

It is certainly getting there!

LikeLike

Yey! 🙂 Do you have a rough idea of what month (or season) you’ll be able to start focusing more on your student loans?

LikeLike

Yeah! I’m targeting the end of March. Not too much longer.

LikeLike

That’s great! 🙂

LikeLike

Congrats Sister Girl! You are an inspiration and a testimony to resilience. 🙂

LikeLike

Thank you, Cathy!

LikeLike

Congrats. Hopefully the second time is the last time. I think that’s got to be one of the more frustrating things imaginable, getting out of debt only to sink right back in. It sounds like in your case it was very unfortunate circumstances, though for many others, it’s simply backsliding into bad habits that they just put on hold, not eliminated. I think that you’ve progressed beyond that, and though you’ve had a pause, it’ll be exciting to see the next step of your journey unfold. Best of luck.

LikeLike

Yeah. Let’s hope the second time’s the charm in my case! I can’t wait to start throwing money at this student loan debt. Thanks, Money Beagle! 🙂

LikeLike

Aloha! I read your ENTIRE blog last night. I am just like you 40s (43 to be exact) with nearly $100,000 debt. I follow Dave Ramsey and many others like him. I am finishing his FPU class this weekend. I have a five-year plan to get out of debt! It starts with getting rid of my studio apartment. Thanks to your tips I’m looking to rent a room! I actually started this mission after my divorce. Now I’m single no dependents so I moved to Hawaii. I can think of no better place to get out of debt! I’ve been here living the high life for 8 months; I’m a teacher and I’m ready to crush debt! Mahalo for your blog and your influence! I love it!

LikeLike

Welcome! I’m glad that my ramblings have helped you. Wow, Hawaii, I’m soooo jealous! If I could get a job in my field there I would be all over it. It’s good to find a personal finance twin. Do keep us updated on how things are going for you. 🙂

LikeLike

Congrats on credit card debt freedom. I am sure this time it will take and you remain free of that burden going forward. I think we develop our spending discipline over time like a GOOD Habit. I still use my reward card but for only budgeted things I need to buy anyway. That way the Bank pays me to use it and I pay off the amount each month with the billing. Credit Cards can just be a tool for us and our budget.

LikeLike

Thanks, Tommy. I think I’m going to stay far away from credit cards for a long while just to be safe 😉

LikeLike

Wow, you are amazing! After everything you have been through, you just keep coming back stronger. The way you have dealt with adversity and have sacrificed is so inspirational.

I have been dealing with a complicated medical situation since 2013 on top of debt from a failed business. I am also a single woman with no children. So, we have some challenges in common. I so appreciate you sharing your story. It’s helpful to see other people who are triumphing over these types of difficult and overwhelming situations.

Good for you on getting out of credit card debt! I hope you really enjoy that well-deserved vacation to see your family. You have more than earned it!

LikeLike

Hi, Cynthia. Thank you for reading and for your kind words. While I wish that no one has to go through the things that we have, I’m always glad to meet someone in a similar situation. I hope your medical situation improves and that things turn around for you financially as well. 🙂

LikeLike