The End of 2020 and the End of a Blog

HAPPY NEW YEAR! WELCOME, 2021.

Thank you to those of you who prodded me and asked if I was going to put up an end-of-year post this year. It’s a bit late, but here it is.

2020 GOALS REVIEW

Back in January of 2020, I only named two goals for the year:

ONE. Max out all tax-advantaged and employee benefit spaces available 401k, Roth IRA, HSA, and ESPP (employee stock purchase plan).

VERDICT: PARTIAL PASS. I managed to max out my 401k, Roth IRA, and HSA. I did not take advantage of the ESPP because by the time the purchase window opened, COVID hit and I had other priorities.

TWO. Stack cash! I plan to add at least $20,000 to my existing emergency fund in order to have a total of at least $30k by the end of the year. I still haven’t determined what my fully-funded emergency fund total will be, but I know that at $10k, it’s currently nowhere near where I want it to be. I want to have enough cash that if I lose my job, I won’t have any stress. Instead of panicking about how I’m going to pay my bills, I’m going to be giddy thinking about the sabbatical I’m about to take from work and getting ready to buy plane tickets.

VERDICT: FAIL. I was on track to meet this goal until I moved out. My emergency fund is now $21,200.

Also from my January 2020 Goal Post:

“That’s what I’m planning. But then again, everybody has a plan until they get punched in the face. (A pearl of wisdom from the philosopher, Mike Tyson.) We’ll see what 2020 has in store for me.”

Prophetic words to be sure. And boy, did COVID have a mean left hook.

STARTING OVER

There were a couple of reasons that caused me to move out of the room I was renting, but the more immediate driver of the two was simple – bedbugs. The last roommate to move in brought bedbugs into the house.

The other woman roommate (before she moved out) and I had some reservations about this guy moving in, but there didn’t appear to be any other options available and Landlord liked him because he would only be staying at the house for part of the week. It now appears he was splitting his time between our house and a halfway house. When I said that Landlord didn’t care who he put in the house as long as they paid rent, I was serious.

The Landlord’s decision ended up biting me in the ass, literally. The new roommate’s bedroom and mine were right next to each other. After repeatedly waking up with mysterious bites, I did some research and finally put two and two together. I had to ditch A LOT (~80%) of my stuff, heat-treat the rest and get the hell out of there asap. I was already primed to leave for other reasons, but the bedbugs were the final straw. I showed up at my new apartment with a few boxes and a backpack.

The Fates sent me a loud message it seems. It was time to move on and start living life. Moving expenses, furnishing an apartment from scratch, increased rent, have taken my entire cash flow since then. At the close of 2020, I’m just about caught up now and will be able to start saving money again soon.

FINANCES

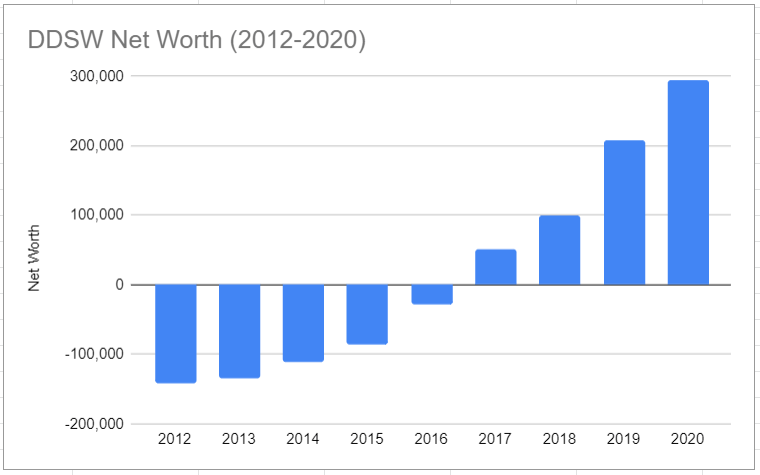

Despite the utter shit-show that was 2020, my net worth somehow managed to increase. At the end of 2019, freshly out of debt, my net worth was $207,414. It is now $295,076 – an increase of $87,662. That’s one bright spot. Most of that increase was clearly stock market gains. The stock market is a fickle friend, however, and these days it seems completely divorced from reality.

WHAT’S NEXT FOR ME?

This blog had one main purpose, to chronicle my journey out of debt. That mission has been accomplished.

Assuming I can keep my (stressful) job in 2021, I’m going to build my emergency fund to at least $25K or $30K, then put whatever is left into my Life Fund. I haven’t figured my life out yet, but I can start saving for it anyway. So I’m putting that part on autopilot for a while.

I’m a year older (mid-40s) and feel like the clock is running out. I feel like I need to make big decisions, but I’m not entirely sure what they are and how to make them. I know I want to focus on growing relationships (easier said than done) and improving my health (also easier said than done).

While I plan to leave this blog up for the foreseeable future, I won’t be posting here much unless something major happens. I just have other priorities right now. I can still be reached via “Contact Me” and comments.

THANK YOU!

Thank you for reading this blog over the years, and offering support and advice. It has been a journey.