[-$107,000] The First Payment

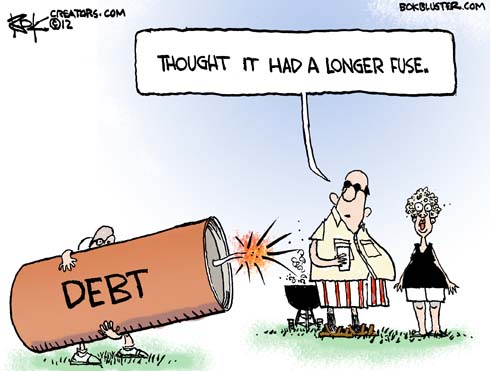

Kill it with fire!

My student loan refinance has gone through and the balance on my previous student loan servicer’s account is now $0.00! I’ve logged in at least 4 times since that wonderful event, just to look at the zeros. Somehow I bet that it is normal to do that. 🙂

I was worried that I would end up with my own crazy-making servicer payoff story when trying to get them out of my life forever. Unsurprisingly, they were super slow in processing the payoff check, probably to rack up the last bit of interest, but they didn’t try any other tricks. Goodbye old servicer! *Waves goodbye*

Now that my student loan debt is situated in its new (servicer) abode, it’s time to burn said abode to the ground!

To adapt the Read More

I

I