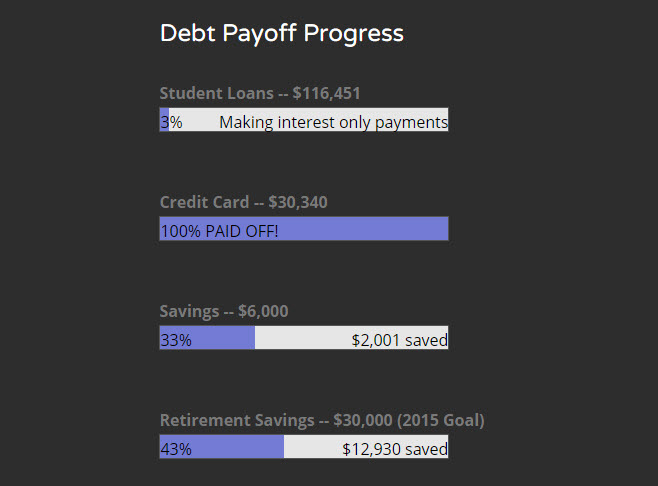

How I Paid Off $30,000+ of Credit Card Debt in Two Years

Yes! Recently credit-card debt free and exhausted from a marathon session of bad dancing, I’m back to share how I did it. By writing this, I don’t mean to imply that everything that I did was necessarily the best course of action, or that it would work for everyone. I’m only sharing what worked for me, a single female with no dependents.

There were 5 simple components that all played a part. None of this was easy to experience, but the steps were simple.

1. I resolved to do it.

I had a wake up call back in late 2012 when I did a bit of math and realized that when my student loans came out of forbearance, I would no longer be able to make ends meet. I knew that I had to start paying off these two debts. Dave Ramsey books and DVDs got me psyched up and motivated. I wanted freedom more than I wanted stuff.

2. I made a plan.

Because my smaller debt (credit card) was also the one with the highest interest rate there was no conflict between the Debt Snowball approach and the Debt Avalanche approach of debt payoff. I knew the credit card would have to go first. We all know that the only way to pay off debt is to lower expenses and/or increase income. I made plans to do both.

3. I reduced my expenses and financial obligations

A. Lowered housing expenses: This was a big one. Yep, I’ve pretty much lived at the poverty level during these two years, not including the time I spent locked into an expensive apartment share right after arriving in the region where I live now. I had to accept the painful fact that I could not afford to live alone with this huge debt over my head. I got roommates. It hurt to realize that, in my late 30’s, I could not afford to have my own place. I hated the loss of privacy, but I had no choice. I had to turn to Craigslist.

B. Lowered other living expenses: I did not have, and still do not have a car. I had no salon visits, no vacations, etc. Yes, I had no life.

C. Reduced the number of financial obligations: In my housing search, I looked for rooms to rent that included all utilities and internet so wouldn’t have to deal with keeping track of those. I cut out miscellaneous expenses. Netflix…gone. Amazon Prime…gone. Now, each month I only pay for three things – rent, student loans, and my mobile phone. (My public transit pass is paid for with pre-tax income directly from my paycheck.)

D. Lowered my credit card interest rate: I got lucky on this one. Because of all the deep debt that I was in, my $30,000+ of credit card debt had an interest rate was 19% and no credit card company would give me a 0% balance transfer option. And why would they? What credit card company would give up hundreds of dollars each month in guaranteed interest payments? It is only because of a deal that I got via my current employer company, that I was able to get a 0% balance transfer. With the interest gone, this helped me a lot to gain traction on paying it down. Yet another reason to be thankful for my current job.

E. Lowered my student loan monthly payment. I changed my payment plan from 10-year Standard to 10-year Graduated. This lowered my monthly student loan payment by $500/mo. I plan to return to the Standard payment plan now that the credit card debt is taken care of.

4. I increased my income.

A. I got a new job. I can hear the eyes rolling. Yes, I know that making more money is easier said than done, but it can be done. How did I do it? It was easy. I got fired. I made my first big dent into my credit card debt by March of 2013. In mid-April, I was fired by my employer. I spent the next four months on unemployment until I started my current position. Back when I was still with my old employer, I didn’t think I’d ever get a job that paid more than what I had been making. I felt trapped. I was struggling with the work and not happy where I was, but was afraid to leave and end up someplace that was worse. Well, my old employer was just as unhappy with me and gave me the axe to put us both out of our misery. I was angry and hurt at the time, but it ended up being the best thing for me. My new job, which is great, pays 50% more per year than my old job. How did I do this? The new job was in a high cost-of-living-area in another state, which was responsible for most of the salary bump. If you can keep your expenses very low (think roommates, and no car), you can skim the difference in salary to put towards your debt.

B. I got a second job. I even got a second job for a while. However, after 6 months, I had to quit it because of the toll it was taking on my health for such low pay.

5. I focused on milestones to bolster perseverance.

When I started making payments, I focused on having a balance under $30,000. After that, I looked forward to having a balance under $20,000, under $10,000, under $5,000, and finally under $1,000. I stayed focused on my mini-goals.

That’s it. The steps were simple. Living through it was the hard part.

Have you paid off a ton of credit card debt? How did you do it? Tell me in the comments.

.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)