Extreme Saving and Early Retirement

Image Credit: andhigherstill.com

Are financial freedom and financial independence still possible for me? Are they possible for you?

I’ve started thinking that once I’ve eliminated this mountain of debt, I could keep my savings rate high for a few more years to try to do some catching up on retirement savings. I know its too late to catch up to 20 lost years of compounding interest. I know that Financial Independence (complete retirement) may never be possible, but at least I could get to place of ‘Financial Freedom’ (aka ‘working retirement’) within the next 10 years.

Meaning that I’ll have to keep working after 50, but I can work where and how I want, knowing that I’ll have enough return from my investments to always have money to afford a basic place to sleep and food to eat. No staying at a terrible job out of desperation. For example, once in Financial Freedom, I could do contract work for 6 months each year and then travel and relax the other half of the year, or get a job overseas, or take a lower paying job in a cool environment with less stress, or hell, work for myself. It’s easy to get giddy at the possibilities.

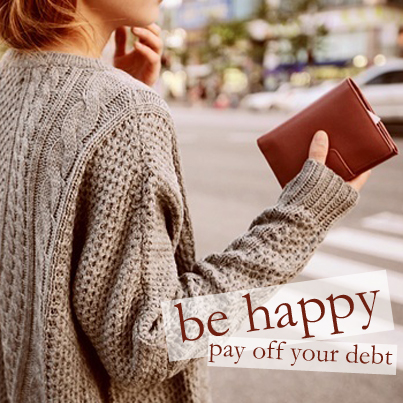

What do I mean by Financial Freedom and Financial Independence? The image below shows my (over)simplified definitions.

Image credit: doubledebtsinglewoman.com

Image term definition: * FU Fund = F@%% You! Fund – This is the money that you keep in savings to protect you if your good working environment suddenly becomes toxic/unstable/etc., and you have to leave before lining up another job.

Want to learn more about extreme saving and early retirement? Two of the best known sources on this topic are Mr. Money Mustache and Jacob @ Early Retirement Extreme. Both of these men ‘retired’ in their early thirties as a result of living on little and saving a lot.

Mr. Money Mustache:

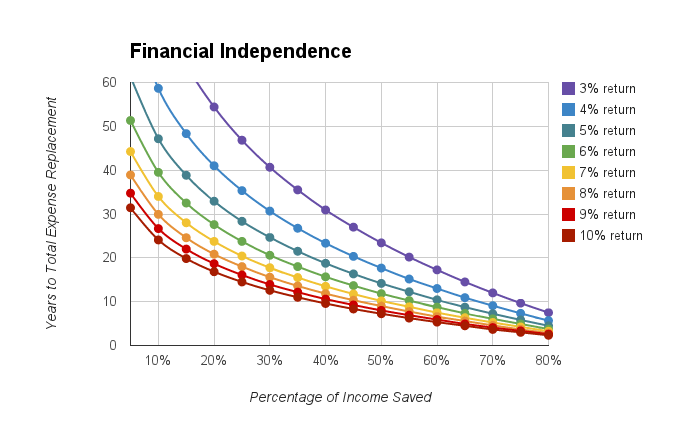

The Shockingly Simple Math Behind Early Retirement

Getting Rich from Zero to Hero in One Blog Post

How I Retired at 32 (Yahoo Finance Article)

Jacob @ Early Retirement Extreme

How I became financially independent in 5 years

As you can tell, Jacob is the more extreme of the two. Both of them have great information-packed sites including forums and other resources.

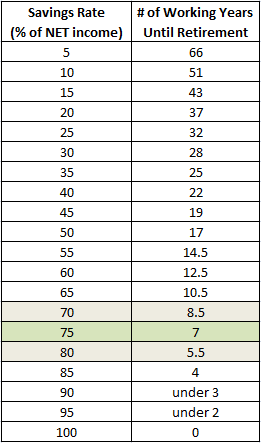

Could I save 75% net income for 7 years to reach Financial Freedom? I’ve seen this table in a few places online, so I’ve re-created it here.

At this savings rate, I could be out of debt in 3 years, and ‘working retired’ (financial freedom) 7 years after that at 50 years old. Wow! Is this even possible for me? Right now my living expenses account for about 23% of my net income per month for a 77% savings rate. Yes, it is possible with sacrifice. Is this reasonable for me over the long-term (several years)? Hmmm.

Therein lies the rub. At this rate I don’t know if I will last in this career for 10 years. I don’t even know if I’ll last in this job for another year. The last few months have been quite stressful. I don’t know what the future holds. Even so, it’s still a goal to aim for and food for thought.

Anyone else consider extreme saving for early retirement?

.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)