Hey Peeps!

I know. I know. Long time, no write.

Where have I been? Where else… at work. I certainly can’t afford to go anywhere else. I had a string of projects that left me too drained to blog. It all culminated in an all-nighter session to get some deliverables submitted on time that took me three days to recover from. Getting older sucks.

Since then, things at work have returned to a manageable level…at least for the time being.

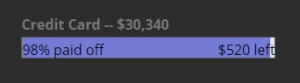

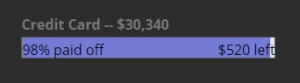

Meanwhile, back at the BatCave, I have some good news on the debt front. As you can see from my progress bars in the footer of this blog, I have made great progress on my credit card debt. I just received a year-end bonus at work. Yeah, I know it’s February, but that’s how my employer works. Anyway, I took every penny of it…well, every penny of what was left after taxes (ouch!), and put it towards the credit card debt.

I now have $520 left in credit card debt!. *screams*

It’s only a matter of days now before the final blade lowers.

I…CAN’T…WAIT..!!!!!

I can’t wait until I can finally end this credit card debt once and for all. I already have a nice place picked out for it to rest…eternally.

I get giddy with excitement every time I think about it. No more credit card debt. Gone forever and hopefully burning in the fires of hell where it belongs. Does this make me sound evil?

I assure all of you that I am not…well, not much. 😉 It’s just that $30,000+ of credit card debt has been financially strangling me for years. I have likely single-handedly financed someone else’s retirement with all the interest I’ve paid over the years. I will not be sad to see that debt die. 😈

Finally, I’ll be able to save up for a small savings fund. The next few months will give me a breather to save at least a $5k – $6k buffer, so I can sleep better at night. After that, I plunge into tackling my mountain of student loan debt. Watch out Sallie Mae, you’re next!

In another bit of good news, my retirement savings (investments) are accumulating faster than expected. I have increased my 2015 investment savings goal (including employer match) from a $20,000 total to an even more ambitious $30,000 total.

In the meantime, will DoubleDebtSingleWoman defeat the Evil Plastic Menace? Come back to see part 2. Same Bat time. Same Bat channel.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)