I started this blog back in late 2012 after realizing that I wasn’t going to pay off my debt as easily as I’d assumed I would after I’d graduated from school. In the days following getting fired from my job back in 2013, my precarious financial situation became even more real to me. I spent a lot of time thinking about my past, present, and future whenever not applying for jobs. ‘Is there a way out of this?’, I’d ask. ‘Will I ever be able to live a “normal” life’ (i.e. my own house, car, nice things)? With a calculator and a notepad, I sat on the old squeaky twin bed that came with the room that I was renting at the time and started doing the math….

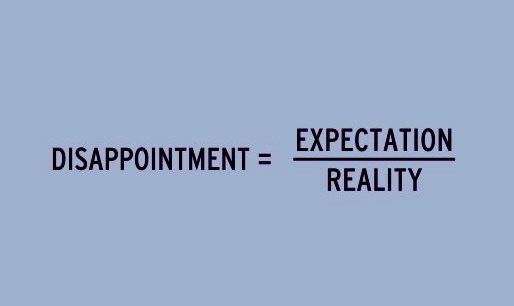

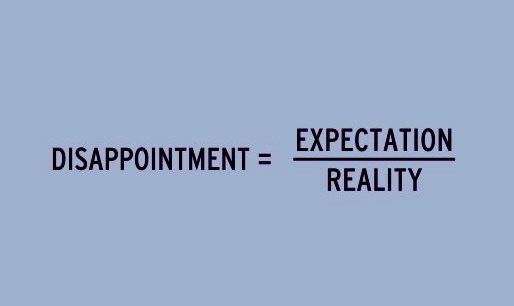

After a period of time running calculations, I accepted the unavoidable truth. I’d likely never be able to afford to pay off all of this debt, own a home and car, travel, afford nice clothes, and save enough for a comfortable retirement. I didn’t make enough money (still don’t), and there weren’t enough working years left. In 10 years, I’ll be in my 50’s and subject to ageism and involuntary retirement. I likely won’t have a spouse or anyone else to rely on in my old age. I’m always hopeful, of course, but also a realist. The odds are against me at this point in life. So that was it… And the illusion crumbled…

I sat there and let it sink in. The rest of my life won’t be like I’d always envisioned it being. The future self, the ‘successful me’, that I’d had in my head all these years would never exist. It was sad to think about. It’s still sad to think about. It was almost like a mourning. I felt like a failure. I still feel like a failure.

As I sat there, the cognitive dissonance started to subside as the rational part of my brain took over again. If there wasn’t going to be enough money to go around, then I had to prioritize and make choices. First, the debt has to be repaid. The consequences for not doing so would be too severe. Seventy-five percent of my 140k+ debt is student loan debt, so bankruptcy was not an option.

Next, I knew that retirement funds would be necessary to support me in my old age. With no retirement savings in my late 30s, I knew that I would have to sacrifice as much money as I could to put into a retirement account when (if) I got my next job. Lastly, I would have to live my life on very little money between then and retirement, only to continue living frugally in old age. That’s not even accounting for needing to take care of my parents in their final years. Frankly, I’m planning that my siblings will be willing to fund most of our parent’s care-taking as they are much more financially well-off than I am. (Hell, who isn’t?)

No house, no nice things, no travel. I’d need to continue living under other people’s roofs, in rented rooms, sleeping on other people’s old squeaky twin beds; at least for the foreseeable future. As someone who cherishes personal space and privacy, this was a bitter pill to swallow. (Side note: Although I’ve moved twice since that day in 2013, I’m currently writing this post on a squeaky twin bed in a rented room). As living with roommates is a constant source of low level stress for me, I realize I am sacrificing a bit of my health because of this.

Around that same time last year when I had my calculator reckoning, I discovered minimalism and simplicity. It was a buoy for me in that it helped me to cope with my situation. It helped me to see that I don’t need ‘nice things’ to be happy. I don’t need to own a home or car. I won’t lie and say that those things wouldn’t be nice to have. I’ve just come to accept that they may not be for me.

Today, I don’t know how my journey on this rock will end. (Would I even want to know?) However, I’m coping with lowered adjusted life expectations, the best way that I know how. I don’t look, dress, or live like other women my age, because of my financial situation. The sour truth is that sometimes I’m treated differently by others because of those differences. Being and looking poor has its disadvantages. I’m planning to re-start work on a couple of side projects that may become a source of side income. I need to find a way to make more money without sacrificing my health. I will do what I can to improve my situation, and to focus on the silver lining to my cloud.

How has debt affected you? What have you done about it?

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)