Hi Peeps! Goodbye 2019 and goodbye debt! This is my LAST ‘Year in Debt’ Review.

Past end of year reviews: 2014 Review | 2015 Review | 2016 Review | 2017 Review | 2018 Review

2019 In Review:

In the Winter, after declaring my 2019 goals, I started the new year by celebrating a student loan refinance, and continuing to cut my student loan debt down to the low thirties. I was also growing increasingly unsatisfied at work and worried about my job. In February, I complained about paying sky-high state and federal taxes, like I always do. By the end of the season, I had reached the twenties, the last stop on my time travel train.

.

By the Spring, after making good debt payoff progress, I decided it was time to “Treat Yo’Self!” and took an actual vacation, just like last year. I was happy and exhausted afterward, but not excited about the money I spent. I started to consider doing yet another student loan refinance because I’d paid off so much in a short period since my last one. I was also worried about staying employed and wanted a lower monthly payment in case I lost my job.

I was unhappy at work, feeling old and stagnant in my job and career. Then, forces that led to my exit from my employer were set in motion. Leadership became more and more difficult. I was just holding on and knowing that my days were numbered. I finally quit that job the second I found a place willing to hire me. With my new job, I set new financial priorities..

.

I started the Summer feeling good about the amount of debt I’d whittled away since leaving that job. I started the new job optimistic that I could continue to chop down debt as quickly. Well, it didn’t take long to realize that with this new job, I’d jumped out of the frying pan and into the fire. I was stressed and miserable and immediately began looking for an escape hatch.

I stopped making student loan payments because I wanted the security of a cash cushion in case I got fired from the new job. After fruitless searches to get jobs elsewhere, I resigned myself to do what I could financially for as long as I was able to keep this job. My goal was to make it through each week. Many times, my goal was to make it through each day. By the end of the season, I was no longer feeling terrified of being fired every day and decided to start putting some money toward my debt again.

.

By the Fall, I was facing more uncertainty because of layoff rumors at the new job. In the end, the layoffs did happen, but I was spared. I was miserable and disappointed not to be let go. Soon after however, I had a mind-shift that helped me to get through that time period. I celebrated reaching the last milestone on my student loan debt, when I dropped the balance down to $10k.

Halloween arrived with an unwelcome visitor. This had me holding steady on debt payments for a short while until things got sorted out. Then, one day in mid-November, I finally got the paycheck that would change my life. And just like that, I was finally out of debt.

.

Now in Winter again, with the year behind me, I’m once again in celebration mode! I don’t feel like I’m being dragged across the finish line like I have at the end of years past. I have settled my employment concerns, at least for the near future. Unlike last year, I’m NOT anxious about what the next year will bring. 2020 will be a year of saving and spending, NOT paying. I’m looking forward to it!

.

Alright. Now it’s time to look at some numbers. For context, I’ve included a shortened version of my goal descriptions from the original 2019 Goals post that I made in January.

.

2019 Goals & Outcomes:

GOAL ONE – Pay off student loan debt from $35,000 to $0.

Goal Description from January: “That’s right! This is the year, the student loan debt monster dies. Last year, I paid off $25,300 of student loan debt. I want to surpass that this year. I’m down to the last $35,000 of debt and I want it dead. Yeah, this is another crazy ambitious goal. But you know my debt motto: go big or go home. I have no idea how I’m going to pay all this off in one year, though. Maybe I’ll win the lottery?

End of 2019 Verdict: PASS! PASS! PASS! Can you tell I’m excited? I met my goal and am ending the year with $0.00 in student loan debt. When I set this goal, there was no way mathematically that I could pay off $35,000 of debt in one year without doing something drastic like stopping all retirement savings. And I had absolutely no intention of doing that.

I made paying off the debt a goal anyway. Well, it happened, but in the unlikeliest of ways. I quit my job (along with half of my team) when the environment became toxic and political following the installation of new leadership. A new job secured at the 11th hour provided (initially) fewer benefits, but more dollars in my paycheck. I used the bump to slay the last of the debt. It’s finally gone!

.

GOAL TWO – End the year with no credit card debt.

Goal Description from January: “I want to end the year with no debt of any kind, including credit card debt.”

End of 2019 Verdict: PASS! I have met my goal and am ending the year with $0.00 in credit card debt or debt of any kind. WooHoo! I don’t owe anyone a damned cent for once in my adult life and I love it!

.

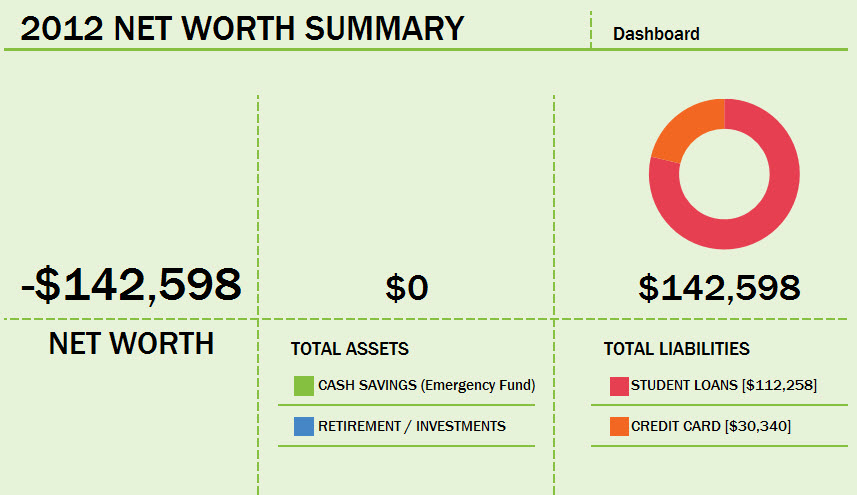

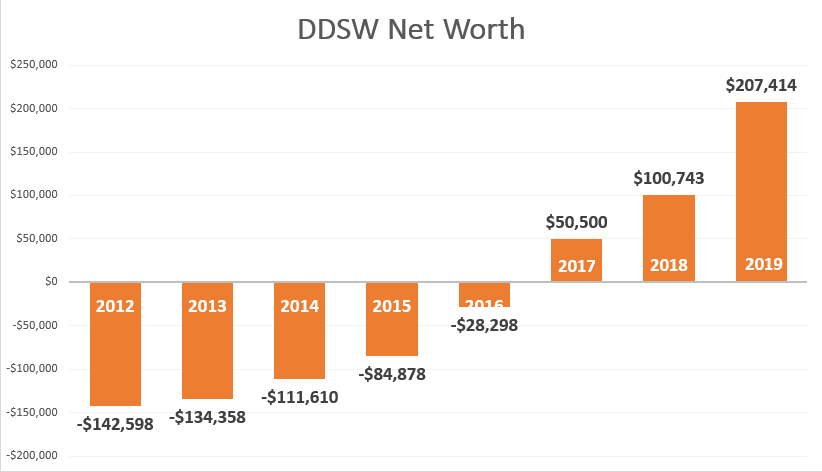

GOAL THREE – Have a positive net worth above $142,258.

Goal Description from January: I’d like to end the year with a positive net worth as large as, or larger than, the negative net worth I started this blog with (-$142,258) back in 2012. I expect the stock market to continue to sink, so this will be a solid goal to strive for. This goal is a symbolic one for me. It will mean that I have finally come full circle on my money turnaround. From -$142k net worth to +$142k.

End of 2019 Verdict: Pass! At the end of 2018, my net worth was $100,743. The stock market held steady and even climbed a bit in 2019. I was also able to stay employed. Both of these things allowed me to meet and surpass my net worth goal. At the end of 2019, my net worth is $207,414. This is a six-figure gain in one year!

.

GOAL FOUR – Max out my 401k, Roth IRA and HSA.

Goal Description from January: “This is a continuing goal. I’d like to keep my monthly contributions as is and not have to divert them toward the student loans.”

End of 2019 Verdict: Conditional Pass. I was able to max out my 401k. In my push to pay off my student loans, I stopped my Roth IRA contributions when I switched jobs. Will contribute max to Roth IRA early next year, so that will be maxed out for 2019. Lost access to HSA for the remainder of 2019 with job change so that goal is no longer included. (I will have access to an HSA again in 2020 with my recent increase in benefits.)

.

Overall Grade for 2019: A+ 😀

Ok, maybe I’m a biiiiit biased, but screw it! I’m giving myself a grade of ‘A+’!. I’ve met or exceeded all* of my remaining financial goals. (*The Roth IRA one won’t be fulfilled until early next year.) Even with everything that happened with my job, in 2019, my net worth grew by over $100,000 this year. In-freaking-sane! I’m very happy with how the year has gone financially!

.

Debt Journey Breakdown (2012-2019)

How did your 2019 financial goals work out? Any surprises?

.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW Archives)

.

.

.

CONGRATULATIONS…I checked your blog like ten minutes before the new year to see if you had posted (you know, instead of writing my own long overdue post). You are so inspiring. I am a 16 months into my debt repayment journey and I can only hope to do what you have done (yes, I am still chugging along despite some bumps (car accidents…yes, with an “s”…as in plural)). Thank you so much for the inspiration! CONGRATULATIONS!

P.S. Have you decided that this blog will live on even if you aren’t writing…or should I be saving my favorite posts? (I followed two other blogs that abruptly disappeared after the bloggers got out of debt (not even a farewell post) and since I have been reading for sixish years, I want to prepare lol)

LikeLike

LoL! Thanks for checking for me. 😀

Multiple car accidents? You okay? You must be looking at those car keys with suspicion these days. 😉

Thank you! I plan to keep this blog up for the foreseeable future. If I ever take it down, I’ll post about it first so there will be advance notice.

I’ll likely post from time to time. Thanks for reading over the years. 🙂

LikeLike

Hi, you definitely deserve an A+. I am very unhappy in my job and planning to hand in my notice this month. It’s terrifying as I’m single with a mortgage but by reading your blog it’s inspired me to take that leap. Life is tough sometimes but you keep going and it gets better. When you look back from where you started you must be so proud of yourself. I Hope you keep your blog going as I’ve enjoyed reading it.

LikeLike

Hi Jane,

Thank you!

What will you do after leaving your job? Do you have savings?

When I left my job this summer, it was only after I FINALLY found another one. With so much debt around my neck at the time, I couldn’t become unemployed.

Because you have a mortgage, I’d encourage you to make sure you have another income source before leaving your job. I wish you the best of luck and thanks for reading!

LikeLike

In Ireland we can rent rooms in our homes tax-free up to E14,000 which I’m doing. I’ll stack shelves in a supermarket if I have too. I need to leave for my own wellbeing. It’s good advice and I’ve started looking. Thanks

LikeLike

I see! It’s good that you have some income already. One day I hope to be like you and be able to leave my stressful job. Best of luck to you and enjoy your upcoming freedom. 🍷

LikeLike

You did it big! Congrats! You are an inspiration. It’s good to know that I’m not the only one that paid off my credit card and ended up using it again. But like you, I immediately paid it back. No more playing games again. I paid that off this year ($8,000) and last year my line of credit ($10,000) as well as something that should’ve never happened at $5,000. I still have an auto loan and mortgage to go and I’m ready to get going but think I will start saving this year since this is the first time that I’ve actually been able to in all the years that I’ve been working.

LikeLike

Thank you!

Congrats on killing the credit card debt and starting to save. Better late than never! I’m living proof of that. 🙂

LikeLiked by 1 person

Thanks. It took a lot of hard work and tears!!!

LikeLike

YASSSSS GIRL! You absolutely deserve that A+! So proud of you and happy for you! I’ll be in your club soon, I’m down to under $19k with my Parent PLUS loans now. Maybe we should plan a celebratory cruise when I get there to celebrate our success! haha

I’m also a “yes, please” vote for you to continue your blog. I’d love to see how your net worth grows and how you’re living your best debt-free life. You might need to change the name of your blog, though. 🙂

Happy New Year and cheers to an amazing 2020!

LikeLike

Hey, TT! 😀

Thanks!

Under 19k already! Slay that debt, girl! Oh, I’m already planning a vacation and I can’t wait! You should totally plan a vacation for yourself to get away from everything. Treat Yo’Self!

LikeLike

I just did! Over the holidays I went to London, Cancun, Charlotte, and Nashville. It was epic!

LikeLike

Woot! That’s how it’s done! I’ve been keeping up with your blog and know how much you deserved it.

Well, you’ll have to plan another trip after all the debt is gone. LoL. 🙂

LikeLike

Yay! I am so proud of you! Money has never been something I am good at managing, I’m just thankful I have enough…but I have been learning, and you inspire me so very much. Happy New Year, indeed!

LikeLike

Thank you! You can totally do it. Thanks for reading! 🙂

LikeLiked by 1 person

Amazing! I love reading about your success on the blog. I paid off my student loans about a year and a half ago, and it is so nice to know that every penny I earn is going towards what I currently want rather than paying for past me’s decisions. Enjoy the many years of upwards trajectory on your net worth!

LikeLike

Hey there! Thank you! 🙂

LikeLike

Congrats on paying off the debt this year! So happy and proud of you! And can I just omg over that six figure net worth increase in a 1 year span! That is so #goals! Looking forward to your future updates!

LikeLike

Thank you! 🙂

I know, right?! I wasn’t even expecting a net worth jump that big. Woot!

LikeLike

Um… so curious how you doubled your networth and paid off $35k(?) in debt in 2019?? Please do tell. I think we make about the same and did not fare nearly as well in the stock market.

LikeLike

Hey! Hmmmm. Well, as you know, I’ve been keeping my expenses low. I rent a “cheap” room and live with multiple roommates. I don’t have a car, and instead, take public transit. I threw almost everything at the debt. In the summer of this year, I left my old job. My new job had fewer benefits but allowed me to take home more in my paycheck than I had been before, so threw the extra at the debt. I also invested in my retirement accounts. The other part goes to an increase in the stock market. That also added to the net worth. I invest almost exclusively in low cost (expense ratio) index funds – nothing fancy. Maybe some of the difference is because more of my money wasn’t paying high interest like in years past and was instead going to principal which boosted net worth. Likely a combination of things.

LikeLike

Well done! So happy for you!

I do very much hope you’ll continue blogging, though of course you should do whatever you want. But to me your posts are like a mix between a dear old friend and a favourite show to binge watch on Netflix. 🙂

LikeLike

Ha ha! Thanks, Maria. 🙂

LikeLike

A+ indeed (ex)DDSW! Glad to see your post-mortem blog, and sincerely hoping you’ll write more in the future. Would be splendid to hear about new achievements in 2020 (maybe a new housing unit all to yourself, an unforgettable trip, and perhaps a new fella ;-)).

For me, this is the month (just a few more weeks), when I do my debt-free scream. Took me ‘only’ 19.5 years. OK, 4 with a more mindful approach. My net worth, regretfully, is nowhere near yours. It’s barely in the +$10-$20K range, so this will be the year – 2020 – when I focus on beefing that up. Hopefully no major set-backs and hopefully I don’t discourage myself from applying to more lucrative ways of banking on my skills. I wish I had your grit on that matter. Just reading about your fruitless job searches and interviews stressed me out. I need to finally put on my big girl pants and put myself out there!

To a fruitful year for all of us, debt slayers and finance experts in the making.

LikeLike

Hey, czanclus!

The trip is being planned! A new housing unit is on my ‘Want to Do’ list, but will happen down the road a bit, once I’ve saved more money. The new fella? LoL! 🙂

Debt-free in a few more weeks?! Woot! What will you do to ‘treat yo’self’ once the debt is gone? A trip? A new fella 😉 ?

LikeLike

Yay! Not much to say, just so happy to see you so happy and relaxed. What a great year. Here’s to 2020!

LikeLike

Hey, C! Thanks! Agreed. Here’s to 2020! 🙂

LikeLike