As I wrote about in my last post, I have been given a salary adjustment at work to remedy my below market pay. In case you haven’t noticed, I’m very happy about this. 🙂

I’ve been in limbo an unable to draft a new budget for two reasons. One, my roommate situation was still up in the air resulting in having higher rent than I had been paying, and two, I didn’t know how much my salary adjustment would impact my take home pay after it got hit slammed by taxes, etc.

The good news is that the roommate situation has been resolved and I am now back to paying my old rent starting next month. Yay! And I finally have some numbers reflecting my new income. Based on the breakdown of my upcoming paycheck, I am expecting an average net monthly income of about $4828 going forward. That’s an increase of roughly $570/mo or so. Not bad at all!

I know I’ve been going back and forth about where to put the extra money. My decision surprised me. I’ve decided that the bulk of the increase (for now at least) will NOT go toward the student loan debt. Yeah, you read that right.

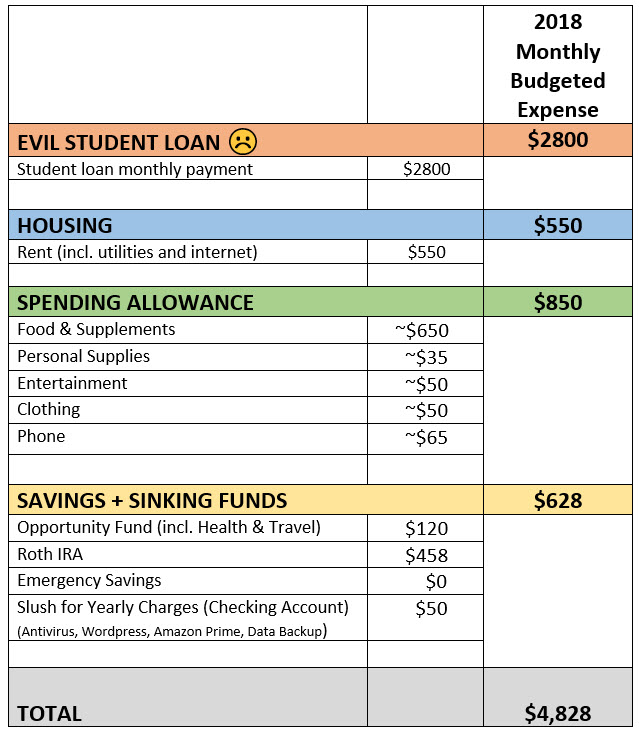

Below is my new spending plan.

Student Loan Debt

I will increase my student loan payments to a little above what I was paying last year ($2700) before I fell off the track. Starting now, I will be putting $2,800 each month toward the debt.

Why not throw all the new money at the debt? Well, I used my trusty debt payment calculator (Unbury.me) and the Student Loan Debt vs. Investment Savings Calculator (Student Loan Hero) to run some numbers.

If I pay $2800/month starting now, I can pay off my student loan debt by the end of November 2019! But if I pay, say, $3000/month starting now, I’ll pay off my debt by the end of October 2019. An increase of $200/month will only shave one month off my debt sentence.

I’m already paying so much every month, that I’m at the point where throwing more money at my loan seems to have diminishing returns. As much as I want to be out of debt as soon as possible, I’d rather use that money and put it towards my Roth IRA. I can wait an extra two months to make the final payment on my student loans, if it means I can almost max out my Roth IRA over the next year and a half. Not to mention not missing the compound growth of those Roth contributions in the years going forward.

Savings / Roth IRA

I decided to start trying to max out my Roth IRA. That won’t likely happen this year, because I’ve gotten such a late start. It’s already May. But I think I can get it half funded this year at least, and maxed out next year. It feels good to know that I won’t be entirely losing yet another year of that $5500 of tax-advantaged space.

Spending Allowance

I’ve increased this from $700/mo to $850/mo. As I’ve written about before, I’ve found it impossible to keep my total spending (not including rent) down below $700, mainly because my food spending is out of control. I live in a HCOL area and eat prepared/restaurant food for nearly all my meals, and…well, enough said. I will take on a special project to trim this down later this summer, but for now, I’ve added more breathing room, so I’m not dipping in to my sinking funds constantly to cover the overspend. It will take effort for me to stick to this new amount, even.

Savings / Sinking Fund

I’ll send $120/mo to my Opportunity fund. Why? Three reasons.

1) I spent some of it down when I bought a new phone (iPhone 8) early last month. Yeah, I finally broke down and did it. I forgot to mention that tidbit with everything else going on. My 5 year old phone just wasn’t cutting it anymore and was starting to fail. I love my new phone, by the way. I can’t believe how much new phone technology I’ve missed out on over the years. I still have about $2k in my Opportunity fund, but I need to keep money flowing into it to make up for this expense and because of reasons two and three below.

2) I’m having some relatively minor, but concerning health related symptoms that have led me to make an appointment with my doctor. If I’m right, I will need medical tests ($$) at the very least. Hopefully, any procedures that may be needed after that will be minor/preventative and not require any expensive treatment. In any event, medical expenses are on the horizon. And don’t forget, I have a high deductible plan, so the first big chunk of expenses are all out of pocket.

3) I have to travel home for a family member who will be in the hospital. I also have two additional family commitments this year that will require cross-country flights. I’ve missed so many family events over the years because of my debt that I’m feeling pressured to do more. That will be another post. I think starting next year, I’m going to have to bake in to my yearly sinking fund enough money to cover travel for one family gathering event and one emergency event each year (my parents are elderly), so I’d don’t feel slammed with the cost of an unexpected ticket. This will also likely be the subject of another post.

.

Energized

That’s my plan of attack for 2018 (and 2019). Things always can and do change, so nothing is ever set in stone, but I feel good about where I’ve landed with things for now. I feel re-energized and ready to crack open a big can of WhoopAss.

The one on the left is my Evil Student Loan Debt. It saw me fall of the track last year. It thinks it’s won and is reveling in its evilness. Behind it on the right, is me, strengthened by my raise, ready to make some big payments again. The evil student loan debt doesn’t know what’s about to hit it. 😈

.

Have you changed your financial plan of attack recently? Why? How?

.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW Archives)

Sounds like an excellent plan! Getting done with your loans in 2019, upping your retirement savings, making space in your budget for some family visits and possible health expenses…

And sometimes you just have to be realistic and realize, like you have done, that you won’t be able to deal with your food budget or whatever just now. You’re putting so much of your money towards debt and/or savings already. But great that you have a timeline-ish for dealing with that too.

I obviously don’t know what they will entail, but hopefully you can still keep the family visits etc relatively cheap.

I’m sorry about your health issues and that of your family member. But I’m so glad you’re feeling energized by your increased income and awesome plan!

LikeLike

Thanks, Maria. 🙂 Now the only thing is to hope that there are no negative changes that interrupt my cash flow. But I’m focusing on the positive of now, not what could happen.

LikeLike

I mean, if you can get back to $2800 payments AND spend what you need to on food, your roth IRA, etc, etc, that is the exact argument for getting a raise in the first place! It means you can do it all! I’m hyped to see you making progress.

LikeLike

Yeah, that’s my goal. 🙂 Thanks, C.

The key to my keeping to this plan will be 1) keeping my cheap rent, and 2) finding a way to lower my food expenses. So I’ve still got some work to do.

LikeLike

Keep up the great work! I am so proud of you.

LikeLike

Thanks! 🙂

LikeLike

I’m so glad you are making choices that suit your life now and your life in the future! That’s important!

LikeLike

Thanks. 🙂

Yeah, I can’t rely on anyone being there to take care of me when I’m old, so if I know I have to save for myself.

LikeLiked by 1 person

Same!

LikeLike

You are doing well with all your plans! The only thing I wish you would do is prepare more of your own food. Eating restaurant and prepared foods just is not healthy, and you certainly want to stay healthy!

LikeLike

Oh, don’t I know it!

Dealing with my food budget and diet will be an initiative unto the itself this year.

LikeLike

Just out of curiosity, no judgment really. Do you eat out/ buy so much prepared food because of your living situation? I’m thinking a shared fridge and kitchen may impact your choices maybe.

Anyway your take down of this debt is amazing!

LikeLike

Yes, absolutely. I’ve mentioned that very issue a couple of times, briefly, in other posts.

Thank you. 🙂

LikeLike

Love, Love, Love how proactive you are in planning but still realize you have to live NOW as well as plan for the future. So impressed you are making Roth payments. Be good to 70 year old you. You are in my prayers to stay healthy!

Be blessed,

P.S. What is HCOL?

LikeLike

Thanks, Cathy. 🙂

HCOL = high cost of living area (Think New York City, Chicago, etc.)

LikeLike

Love the new budget plan. And I really like that you are able to plan for future travel expenses too. It’ll be great for your debt repayment, but more than that, it’ll be great for your own mental health. Having that accounted for will help make any future unfortunate circumstances just a little easier to handle. Well done!

LikeLike

Thank you, Jena. 😊

LikeLiked by 1 person

Such a well thought plan. Truly personalized for you wjich makes it great. Hope all goes well with your testing.

LikeLike

Thank you. 🙂

LikeLike

Big congratulations on getting down to $51,000. I can remember not long ago when you were on over $100,000. It seems like you’re very much in control of things. As I’ve said before, once you fall below about $25,000 it stops being a great burden and becomes a manageable weight. Good luck, I will be rooting for you all the way.

LikeLike

Thank you, Paul! 🙂

LikeLike