See my past end of year reviews here: 2014 Review | 2015 Review | 2016 Review

2017 In Review:

In the Winter, after declaring my 2017 goals, I soon developed a new found interest in beefing up my emergency fund. After waiting for months following my promotion at work, I finally learned what my pay raise would be, and it was disappointing to say the least. I bounced back from that let down, and set aside some money from my bonus to fund my sinking funds. This included a ‘health maintenance fund’ for doctors visits and medical tests, as I was getting concerned about some chronic health issues.

By the Spring, I celebrated being ‘In the Papers’, as I was mentioned in an article published in MarketWatch and NY Post. I entered the 70’s wearing bell bottoms and ‘Stayin’ Alive’. I lamented the high taxes that I and other singles pay. In a big milestone post, I celebrated being ‘worthless’ (reaching net worth 0). I also had a tantrum or two about still having to live with roommates and complaining about how our tax dollars are spent.

I kicked off the Summer feeling strong, as I was named a ‘Student Loan Conqueror’. Even with my budget overspending creeping up, Independence Day motivated me to keep striving to lower my debt as it would get me closer to my own (Debt) Independence Day. I was also mentioned in a Student Loan Hero article about the ‘financial benefits of being Single AF’. I, soon thereafter, slid into the 60’s, in my boogie threads and spent a dime ‘Down on the Corner’. I ranted about public transit (again) and celebrated having a solid streak of extra debt payments. As the summer ran out, so did my ‘health maintenance fund’. Turns out tests and doctors visits are expensive. Who knew?

In the Fall, I was upset about the Equifax data breach and how our ‘secure’ information is anything but. My budget overspending continued and I began to consider that I may need to readjust my debt payment expectations. In student loan news, a cool, small student loan servicer was acquired by big bad one. I further lamented ‘falling off the track’ with my budget and debt payoff and acknowledged that I have debt fatigue. I’m not happy with the effect that it’s having on my debt repayment. I reminded myself of a few things I’m thankful for as I celebrated both Thanksgiving and this blog, Double Debt Single Woman turning 5 years old.

Now in Winter again, with the year winding to a close, I feel as though I’m being dragged across the finish line into 2018. Despite the exhaustion, I’m optimistic for what next year will bring.

.

Alright. Now it’s time to look at some numbers. For context, I’ve included a shortened version of my goal descriptions from the original 2017 Goals post that I made in January.

2017 Goals & Outcomes:

ONE – Pay down my student loan debt from $88,935 to under $65,000.

Goal Description from January: “This is doable as long as I stay on track with my mortgage sized payments. It will be a great feeling to be closer to $50k than to $100k. At that point, I can start to breathe more and hyperventilate less.”

End of 2017 Verdict: PASS! Even with my smaller payments over the past few months (debt fatigue), I have surpassed my goal here and am ending the year with $60,300 in student loan debt.

TWO – Max out retirement accounts – 401(k), HSA, and Roth IRA.

Goal Description from January: “I have absolutely no idea how this can even be pulled off, but why not throw this in as a goal anyway. … No matter what the markets are doing, I can’t keep losing time by investing so little. The number of years I have left to work are finite. Every year that I’m not taking advantage of these accounts is a loss.”

End of 2017 Verdict: Conditional Pass. I have managed to max out my 401(k) and HSA this year. Woot! I have been debating with myself about what I should do with my annual bonus when I get it. I’m saying “when I get it” because my employer has had record profits this year, so I would be shocked if we get a below average bonus. I’m heavily leaning towards putting it in the Roth IRA. If it works out, the bonus should be juuuust enough for me to max it out and complete this goal. But I won’t know for sure until bonuses are handed out in early 2018.

THREE – Increase emergency fund to $4,000.

Goal Description from January: “A fully funded emergency fund for me would be a solid 1 year of living expenses. That’s totally not realistic for me to save right now, but I would like to build up to a partial fund of at least $8,000 in the next couple of years or so. My past e-fund goal, $6,500, no longer feels like enough to aim for. As such, the $2.500 that I have in there now is feeling way too small to provide much protection, so I think $4,000 will be the least I can tolerate having in there by the end of 2017.”

End of 2017 Verdict: PASS! Because I often go back and forth in what my financial priorities are, this is another example where I had a change of heart and decided that I wanted more security with a larger emergency fund. I kept contributing to my emergency fund every month until I built up $6,500. Then in November, a family member gifted me $3,500, which I immediately put into the emergency fund. This gave me a nice round $10,000 total.

FOUR – Cross-over into Positive Net Worth.

Goal Description from January: “My current net worth is $-28,307. If all goes well with my debt reduction and retirement savings, I will be within striking distance of reaching a positive net worth for the first time in my adult life. The biggest potential obstacle to meeting this goal will be the overheated stock market. Our dear Bull (Market) is rather long in the tooth and could be on its last legs. We are overdue for a major market correction. If this correction happens in 2017, and if it’s large enough and long enough, it could theoretically keep me in the red for another year.”

End of 2017 Verdict: PASS! Thankfully, the market drop hasn’t happened (yet). Not only have I crossed over into positive net worth this year. I’m ending the year with a net worth of $50,500. This represents an increase of $78,798 for the year! This is an insane amount of growth. I’m still not entirely sure how this happened. Even though I know the stock market did very well this year, I was not expecting it to increase this much. Yay! While not out of the woods, I’m finally above ground, at least.

FIVE – Reduce the Fat (both belly and budget) and Monitor my Health.

Goal Description from January: “I have a $600/mo living allowance (food, clothes, supplies, entertainment, etc) that I overspend on every month, mostly because of food expenses. In my defense, food is expensive out here, yet I need to get this under some semblance of control. I’d also like to lower my body fat by some yet to be determined percentage.This will entail improving diet and physical fitness. I cannot and will not promise to have a perfect diet, but I can make improvements.”

End of 2017 Verdict: FAIL & FAIL. OMG! Where do I even start on this long train of fail cars? I have gained 5 pounds since January. I stopped going to gym after 1 month because that’s all the time it took for me to overdo it and injure myself. That and the gym being 45 minutes away (walking), which was aggravating existing foot problems and quickly became a painful commute. It wasn’t sustainable. I’ve overspent my allowance almost every month. My body fat is even higher, particularly belly fat. Combined with my permanent bloating (perma-bloat) I look like I’m pregnant all the time. Not a good look. My cholesterol is still too damn high and relatedly, I’m still eating restaurant and prepared foods all the time. Sigh.

.

Overall Grade for 2017: B+

I’m giving myself a grade of ‘B+’. I’ve met or exceeded all* of my financial goals. (*The Roth IRA one won’t be fulfilled until I get my bonus). My net worth is really starting to grow. However, this year I’m ending the year with credit card debt (booo hisss). What’s more, I failed my one health related goal so hard, that it pulled down the average rating, resulting in a B+ again this year.

.

Debt Journey Breakdown (2012-2017)

That’s all folks!

How have your 2017 goals worked out?

.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW Archives)

You did fantastic! It’s so amazing to see all that you’ve accomplished this year! I feel you on the health front with staying in shape and losing weight. I’ve tried running outside and working out to youtube videos in my apartment, but I can’t seem to make myself stick to a schedule. I will have to focus on that more in 2018. It’s really awesome to see the positive net worth. I know how hard you’ve worked on achieving that goal. 🙂

As far as my own goals, I did ok this year. I would give myself a B- at best for completing all of my goals. As you know, I was able to accomplish my major goal of becoming debt free in August 2017. But for the rest of the health, art, vlog/blog, etc goals, most of them weren’t accomplished due to laziness and excuses. 😦 Something I definitely have to work on this upcoming year.

LikeLike

Thanks! It’s amazing how it all adds up over the course of a year.

Yeah, sticking to a routine when trying to workout from home is the hardest thing ever. I haven’t been able to do it so far. But I’m not giving up.

It must feel great to have that debt off your back! Congrats again!!! 🙂

LikeLike

I want you to know how awesome your debt paydown is – that is basically my entire salary for the year and then some (gross salary too!!)

At the rate you’re going, I see that debt gone in about 2-3 years, am I right?? Then you will be able to live so freely! You set a lot of goals for yourself this year and passed so many of them. Very happy for you. I need to figure out my financial goals for this next year too. Maybe I should blog about them? 🙂

LikeLike

Thanks, Terri. I’m so surprised that my net worth increased as much as it did. I think a chunk of it was record breaking stock market returns and employer 401k matching etc, so I wasn’t doing everything myself We’ll see how things hold up next year.

Yeah, at my current rate I expect to be out of debt in 2-2.5 years. I can’t wait. I can’t wait. I cannot wait!!! Did I mention that I can’t wait?

Yes, do blog about your financial goals. I, and I’m sure others, will be interested and ready to cheer you on! 🙂

LikeLike

That’s a huge change in your net worth for one year. Well done! It just gets easier from here as the interest payments go down and the returns on investments go up.

LikeLike

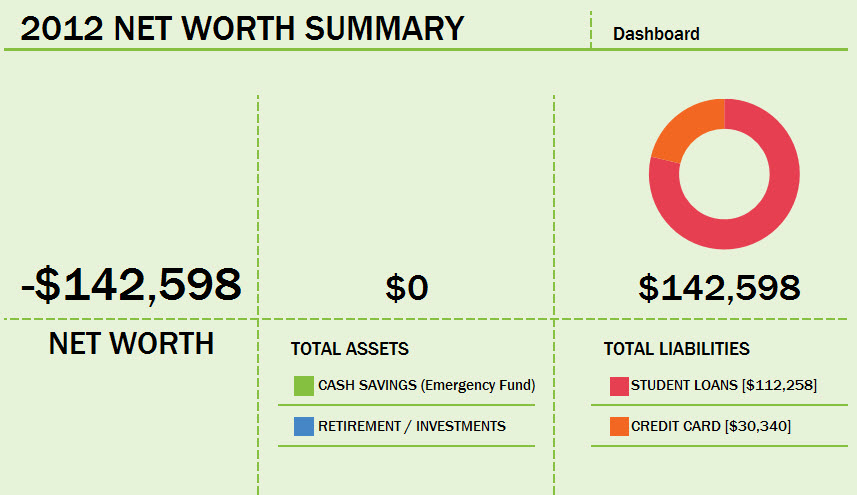

Thanks! When I started this blog, I remember being so upset about how much I was paying in interest on my $112k student loan. Now I’m moving towards having that much in investments myself and getting PAID interest instead of paying it. I will enjoy being on the right side of interest (instead of the wrong side.) 🙂

LikeLike

Wow, that is amazing progress, congratulations! 😀

I think that as your debt and related stress decrease even more, it’ll be easier to focus on and achieve your other goals too, health and fitness etc.

LikeLike

Thanks, Maria. Yes, that is exactly what I’m counting on.

LikeLike

Oh, keep pushing! The end really is in sight. Fight that good fight and DON’T give up. You should be proud as you compare the beginning to the present.

LikeLike

Thanks! As I get more debt paid off, I get more motivated. I’m beginning to feel like I’ve finally pushed the boulder up and over the crest and it’s now finally starting to roll downhill.

LikeLike

I am so impressed with your determination and discipline. You now have slightly more in assets than the amount of student loan debt you started with! Keep up the fight, and know you have people out here cheering for you.

LikeLike

Thanks, Sharon! The support from you guys has been so encouraging.

LikeLike

You did such a great job! Debt fatigue is real! I hope you find the balance in treating your body in a way that feels best for you.

My year was not great, but hopefully 2018 will see a turn around.

LikeLike

Thanks! Yes, I’ve been slogging at this infernal debt for over 5 years. This kind of rapid debt payoff

is difficult to sustain for years on end. It’s easy to start to slip. But I’m not going to complain about the money that I lost from overspending. I still made great progress, so I’m focusing on that.

Your 2018 will be better…because I say it will. 🙂 As you know, many, if not most, small businesses take a couple of years to so to hit their stride. Plus you’ve learned a lot and make connections that you didn’t have before. Things are looking up for you. You can do it!

LikeLiked by 1 person

I appreciate the encouragement. So much.

LikeLike

It absolutely blows my mind how much progress you’ve made. This is clearly the year you absolutely blow past me in net worth!

LikeLike

Hey, C! Yeah, I’m hoping to make some serious GAINZ in my net worth. I’m so far behind. The 2017 growth was way beyond my expectations.

Ha! By the time you’re my age you’ll be far past where I am now. 🙂

Best of luck to you in 2018 as you get back on track. Let’s rock it!

LikeLike