This is a big milestone for me. I’m completely worthless, guys…. FINALLY! 🙂

I now have a positive net worth for the first time in my entire adult life.

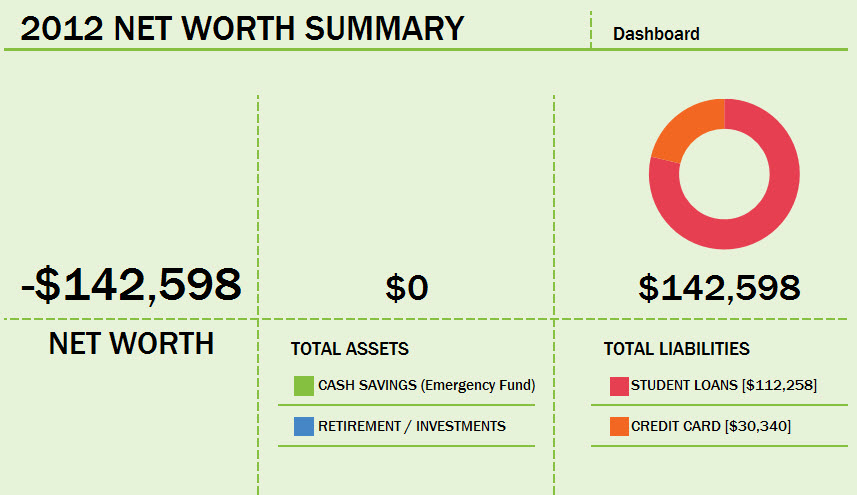

When I started this blog, I was in a ton of debt and didn’t have a dime of savings. Don’t believe me? See the crime scene for yourself.

November 2012 Net Worth

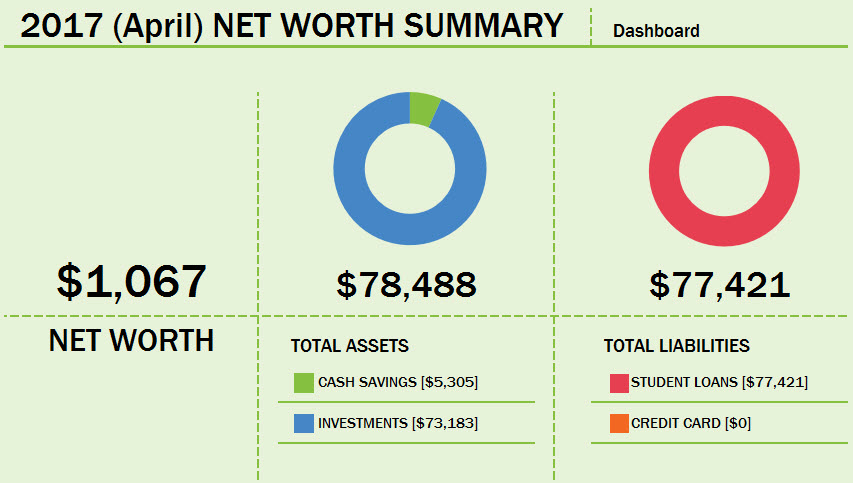

April 2017 Net Worth

Today, I have a small (and growing) retirement fund and have almost halved my total debt.

.

How I Did It

1. I had a wake up call.

I had a wake up call back in late 2012, when I did a bit of math and realized that when my student loans came out of forbearance, I would no longer be able to make ends meet. I knew that I had to start paying off these two debts. Dave Ramsey books and DVDs got me motivated. I wanted debt freedom more than I wanted stuff.

2. I reduced my expenses and financial obligations to free up money

A. Lowered housing expenses: This was a big one. I had to accept the painful fact that I could not afford to live alone with this huge debt over my head. It hurt to realize that, in my late 30’s, I could not afford to have my own place. I hated, HATED, the loss of privacy, but I had no choice. I had to turn to Craigslist. I went out and moved into a rented room in someone’s house. I’ve had roommates ever since. And yes, I hate it; but it’s the price I have to pay.

B. Lowered other living expenses: I have not had, and still do not have, a car. I walk everywhere or take public transit. I have no hair salon visits, have only had one vacation, don’t “go shopping”, etc. Yes, I have no life.

C. Reduced the number of financial obligations: In my housing search, I looked for rooms to rent that included all utilities and internet so I wouldn’t have to deal with keeping track of those. I cut out miscellaneous expenses. Netflix…gone. Online services I wasn’t using…gone. Now, each month I only pay for three things – rent, student loans, and my mobile phone. (My public transit pass is paid for with pre-tax income directly from my pay.) I have only four other expenses which are paid once yearly: WordPress, antivirus protection, Amazon Prime, and file hosting / data storage.

D. Temporarily lowered my student loan monthly payment while paying off the credit card debt. I changed my payment plan from a 10-year Standard to a 10-year Graduated. This lowered my monthly student loan payment by $500/month and helped me gain traction with my credit card debt. Once the credit card was paid off, I changed my student loan payment plan again.

3. I increased my income.

A. I got a new job. I can hear the eyes rolling. Yes, I know that making more money is easier said than done, but it can be done. How did I do it? It was easy. I got fired. I made my first big dent into my credit card debt in March of 2013. In mid-April, I was fired by my employer. This was when I hit rock bottom. I spent the next four months on unemployment until I started my current position.

Back when I was still with my old employer, I didn’t think I’d ever get a job that paid more than what I had been making, which wasn’t much to begin with. I felt trapped. I was struggling with the work and sad where I was, but was afraid to leave and end up someplace that was even worse. Well, my old employer was just as unhappy with me and gave me the axe to put us both out of our misery.

I was angry and hurt at the time, but it ended up being the best thing for me. My new job, which is not perfect, but better, pays almost 50% more per year than my old job. How did I do this? The new job is in a (HCOL) high cost-of-living-area in another state, which was responsible for just about all of the salary bump as employers in these areas often pay higher salaries to compensate. If you can live in a HCOL area like this and keep your expenses very, very low (think multiple roommates, and no car), you can skim the difference in salary to put towards your debt.

B. Investment returns increase net worth. Ever since I started my current job a few years ago, I’ve set aside and contributed something to the 401(k) plan here, even if it wasn’t much. At my age, I never had the luxury of foregoing retirement savings while I focused on debt. Even though I don’t have a ton of money invested so far, every few hundred dollars of gains, put me a little bit closer to my future goals. Yes, market corrections and drops happen, and I will weather them when they do, but I always keep my view toward the long term.

4. I attacked my debt like Insanity Wolf

A. First, I attacked my high interest credit card debt and paid it off: Because of all the deep debt that I was in, my $30,340 of credit card debt had an interest rate of 19%! No credit card company would offer me a 0% balance transfer option. And why would they? What credit card company would give up hundreds of dollars each month in guaranteed interest payments?

It is only because of a deal that I got via my current employer, that I was able to get another credit card with a 0% balance transfer. With the interest gone, this helped me a lot to gain traction on paying it down. Yet another reason to be thankful for having a job. If you work for a large employer, check your employee benefits. After paying it off I performed a marathon session of bad dancing.

B. Next, I attacked my student loan debt and am paying that off with intensity. As soon as my financial situation stabilized after getting rid of the credit card debt, I focused on the 12 individual student loans (totaling $112,258) that I had accumulated with high interest rates. While I was focusing on paying off my credit card, I made the minimum payment on my student loans. It was disheartening to see that minimum payment on those student loans was comprised, almost entirely, of interest. I was throwing away hundreds of dollars (~$600) every month in interest payments.

A couple of readers of this blog (Thank you, guys!!) mentioned refinancing as a way to get a lower interest rate. I’m glad that I refinanced my student loans. Now, less money goes to interest and more goes to principal. Thanks to annual cost-of-living salary adjustments at my current job, I put a bit more money into my monthly payments every year. I am now making the biggest payments that I’ve ever been able to. Part of any bonus and tax return also goes to the student loan.

5. I focused on milestones to bolster perseverance.

When I started making payments on my credit card, I focused on having a balance under $30,000. After that, I looked forward to having a balance under $20,000, under $10,000, under $5,000, and finally under $1,000. I stayed focused on my mini-goals.

For my student loans, I’ve been celebrating every $10,000 reduction as a mini-milestone as well – such as the 90’s, 80’s and 70’s.

Having this blog and all of you guys cheering me on from milestone to milestone helped more than you can know. Thank you!

.

Remember, that while the basic steps are simple, living through it has not been easy. Stay the course.

Next Steps

What’s next for me? I have three major financial goals still ahead.

ONE. Pay off the remaining $77,421 of student loan debt sometime in 2019 and finally taste sweet, sweet debt freedom!

TWO. Starting sometime next year, max out all retirement savings vehicles, including the Roth IRA, which I haven’t contributed to in a long while now.

THREE. Save one full year of living expenses in an emergency fund.

.

Have you gone from being a Zero to, uh, net worth zero? How did you do it?

.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)

[A list of all Double Debt Single Woman posts on one page]

That is so holy freaking awesome, congratulations!!

LikeLike

Thanks, Abbie!

LikeLiked by 1 person

This is just fantastic, DDSW! Here’s a loud cheer from the peanut gallery. Hurrah for you! You have really stayed the course, and the light is there at the end of that long, dark tunnel.

LikeLike

Thank you, Isabella! Yeah, a little bit longer and I should start seeing the first glimmer of light. Looking forward to it.

LikeLike

Very well done DDSW. It makes a big difference psychologically to be in an overall credit balance in life. You have achieved several milestones recently. I look forward to your next big one coming, maybe $5,000 overall credit. Please keep up the good work.

LikeLike

Thanks, Paul! Yes, and I’ll feel the difference even more once I get more of this debt paid off. Stay tuned. More milestones ahead.

LikeLike

Maxing out retirement is going to be a piece of cake once your loans are paid off! Congratulations on hitting $0!

On an unrelated note, I think we’ve been tracking our debt since around the same time. Thanks for continuing to post–it’s really motivating knowing I’m not alone in this!

LikeLike

Thanks! Yeah, it’s good to have a sister in the struggle. 🙂 Thanks for nudging me to look at doing a re-fi. It has helped so much. Hang in there.

LikeLike

Good for you!! So exciting to reach that milestone. I can’t wait to get there someday! I always enjoy reading your blog and seeing your progress.

LikeLike

Thanks, Robin! Best of luck on your own progress. Do you have a blog? If not, check in here from time to time and let us know how you’re faring with your repayment. 🙂

LikeLike

This is wonderful! Congratulations! I love reading your blog and I continue to be inspired by your hard work! It is great motivation! Keep it up! Slow and steady wins the race everytime! 🙂

LikeLike

Thank you, Erika! I often wish this payoff didn’t have to be slow. 🙂 Why can’t I just win the lottery already??!! 🙂

LikeLike

Congratulations, so happy for you!

I’m curious about something, if you’re willing to answer: When you have your debt paid off, do you think you’ll prioritize getting your own place, or do you think you’ll continue to stay with roommates for a while to be able to put even more towards savings? I know this will probably depend on many other things too, job situation etc.

LikeLike

Thanks, Maria! Once I’m out of all debt, I plan to save for my emergency fund while I look for a new place. I expect that it will take months to find a place of my own that is not totally outrageously expensive. But yes, it will more likely depend on whatever my life situation is two plus years from now.

LikeLike

YES. So awesome! At my lowest moment I went from $0 in assets, and about $25,000 in debt, to zero net worth, to my first positive net worth. It took about a year, since I didn’t have as far to go, and I was blessed with (for me) an unusually well-paying temporary job during that time. So, my road was easier. But fundamentally the same factors of commitment to the cause and keeping my expenses super low were the main things. You had so far to go and I’m super psyched that you’re here! You will just keep feeling better and better as you go.

LikeLike

Thanks, C! I can’t wait to get to where you are – totally debt free and stacking dollars. 🙂

LikeLike

Amazing news! Congrats! You’ve obviously worked hard!

LikeLike

Thanks, Amanda! Things are just getting started… 🙂

LikeLike

You should be so proud of yourself. Your readers certainly are!

LikeLike

Thank you for all the encouragement! 🙂

LikeLike

Sooo jealous at your worthlessness! But really, mostly happy and glad. Don’t trivialize it, not anyone can do it. It takes serious self-restraint to get this far.

I tallied my finances, and without counting a meager couple grand that are lying in some obscure retirement account and accumulating nothing substantial these past two years, I’m just about a marathon’s distance (26.2 miles ~ $26.2K) worth of 1000$’s in the hole. I did not bother tallying up my furniture and electronics for which I could get maybe $5K in total. It’s not worth the hassle.

My (big 4-0) birthday is coming up in 3.5 months, and by then, I have decided to settle on a career path and to start bringing in the kind of money that can allow me a positive and growing net worth 3 years of toiling hence. I’ve reduced my budget so much by now, and I track literally every penny spent and earned, that I’m finding that the only (dignified) way to accelerate the debt prison release is with a “bigger shovel.”

Rooting for your next milestone, and by summertime, we’ll see you in the 60’s. 🙂

LikeLike

LoL at the worthlessness. Thanks!

Hey! Almost $26.2K of debt now. Are you still planning to launch your blog?? Looking forward to it, if so. 🙂

Congrats (?) on the big 4-0. I was not in a party mood when I turned 40. It seems that you are wisely using this marker as a turning point in your career. If you haven’t looked into it, there should be educational programs / scholarships for nontraditional students and single moms, etc.

I’m looking forward to the 60’s too. Ahhh.

LikeLike

THIS IS WONDERFUL!!!! I’m so happy you’ve reached this milestone! It’s also very encouraging for me. I am still at net worth BIG NEGATIVE number, but I know I can follow your path and join you in a few years!

LikeLike

Thanks, Zeejay. I’m cheering you on!

LikeLiked by 1 person

Likewise!

LikeLike

Congrats, congrats!! Don’t you feel like the weight of the world has been lifted?! I feel like there is so much freedom in being “net positive” that a lot of people will never experience!

LikeLike

Indeed! Thanks, Wendy!

LikeLike

Congratulations! What an accomplishment! Your story is quite inspiring…way to stick with it despite how tough its been! I look forward to seeing what’s next!

LikeLike

Thank you! I also look forward to seeing what’s next. 🙂

LikeLike

That is inspirational, you are inspirational! No doubt you are going to pile one success on another. I never had any debt and always feel a little guilty that my life has been so easy. People like you that climb out of a deep hole and then climb the mountain, well, you are just better than me and that’s absolutely fine. I love having people to admire! Keep it up, you’ll help more people than you know.

LikeLike

Thanks, Steve. You know I wonder sometimes what my life would be like if I hadn’t accumulated all this debt. I might be somewhere living paycheck to paycheck like I was brought up to do. I wonder if I would have learned about personal finance without anyone in my life to model another way of living. Sometimes I think the debt was a perhaps a good thing. ( I wish I hadn’t racked up quite so much of it though!) Ha! Maybe this blog should be made required reading for all college-bound seniors planning to take out student loans. A cautionary tale if there ever was one…

LikeLike

Wow congratulations! That is amazing!!!

LikeLike

Thanks, Tonya!

LikeLike