First, the good news.

I finally got my 2016 bonus check ($4,922)! Woot!! I now have ALL the money! lol

This is how I have allotted it.

- Health maintenance fund ($2,500)

- Opportunity fund ($1,250)

- Emergency fund ($222)

- Checking account / slush ($500)

- Evil Student Loan extra payment ($500)

I also made my first $2,650 monthly mega payment (up from $2,300). The resulting balance ($83,896) barely looks like it’s even moved since last month. Still pretty much in the mid-80’s.

Why is so much going to my health fund? Keep reading…

On the Downward Escalator

After 40, it can feel like we’re all on the downward escalator. Health issues appear, or worsen. Our weight and mid-sections increase. It becomes harder to maintain health without substantially more effort; like continually running up an escalator to get back to where you used to be and the health you used to have.

It can make us wonder about our own mortality. How should we prioritize our time when, unlike in our youth, it becomes apparent that we won’t live forever, or even last into old age with good health. Sometimes I think, like Grace from her (now defunct) blog Graceful retirement, what if I only have 15 good years left?

My Health Goals for 2017

I’d also like to lower my body fat by some yet to be determined percentage.This will entail improving diet and physical fitness. I cannot and will not promise to have a perfect diet, but I can make improvements. Gym membership, perhaps a few personal training sessions and higher quality food will require money. I also will be meeting with a couple of doctors in the coming year to start to address some increasing health concerns. Doctors visits cost money too. Sigh. (2017 Goals Post)

Before I can set specific goals, I need to determine my starting points. In the past I’ve only learned my weight during doctors visits. I never focused on it enough to own my own scale. Well, I decided to get some numbers around my health goals. I went a bit overboard perhaps and got a fitness tracker and one of those fancy scales that tell you your heart rate, body fat percentage, muscle density, bone density, etc. Oh yeah, and it tells you your weight too! Well, after a few days of putting it off, I decided to bite the bullet and record my starting numbers.

Weight – I’m officially at the heaviest weight I’ve ever been in my life. I’ve gained over 15 pounds since I lost my last job and moved here. Stress, hormones, poor diet, lack of sustained exercise, more stress… Ugh!! Not long ago I donated a bunch of clothes that I couldn’t fit into anymore and then had to buy a size up. For the longest time I thought my clothes were shrinking! LoL! Then I started to see and feel the fat around my midsection. I don’t like the way I look in the mirror. I would like to lose at least 7 pounds of fat and convert the other 8 pounds to muscle gain.

Body Fat – According to my fancy scale, my body fat percentage is 28-29%, which is toward the higher end of the “Acceptable” range for women. However, “Obese” starts at 31%, which isn’t that far away! Eeek! I’d like to be in the general “Fit” category of 21-24%. I think 24-25% is a good target percentage to shoot for.

Resting Heart Rate: So far, mine is clocking in at an average of about 86 bpm. While not an abnormally fast rate, it is not healthy. A resting heart rate of a healthy person is in the 60s bpm. According to general scales and research, my heart health looks poor. POOR! Check this quote from Harvard University health blog:

For example, a 2013 study in the journal Heart tracked the cardiovascular health of about 3,000 men for 16 years and found that a high RHR was linked with lower physical fitness and higher blood pressure, body weight, and levels of circulating blood fats. The researchers also discovered that the higher a person’s RHR, the greater the risk of premature death. Specifically, an RHR between 81 and 90 doubled the chance of death, while an RHR higher than 90 tripled it.

Three words folks: WTH?? I swear, this debt is literally killing me.

Cholesterol: Somebody call Jimmy McMillan. My cholesterol is too damn high! My cholesterol has never been low, but my current numbers are downright scary. This year (recent blood test), it is in the high 200s. No, that is not a typo. Aieee! I feel like I’m practically a heart attack waiting to happen. Stress, poor diet, more stress, age, family history, even more stress are big factors. I’m fairly certain an underlying health issue is contributing to my numbers being this out of control, beyond just diet. This number has to come way, way down, obviously.

My Plan of Attack

ONE. Get some lab work done.

- I have a doctor appointment set up to start putting together the pieces of my ongoing health issues. These appointments, tests, dietary changes, and possibly medication will cost $$$, so it remains to be seen if my new $2,500 health maintenance account will cover things this year. One test that I may have to have costs between $400-800 by itself. I have my HSA as a backup, but hopefully I won’t have to tap into that.

TWO. Get regular physical activity.

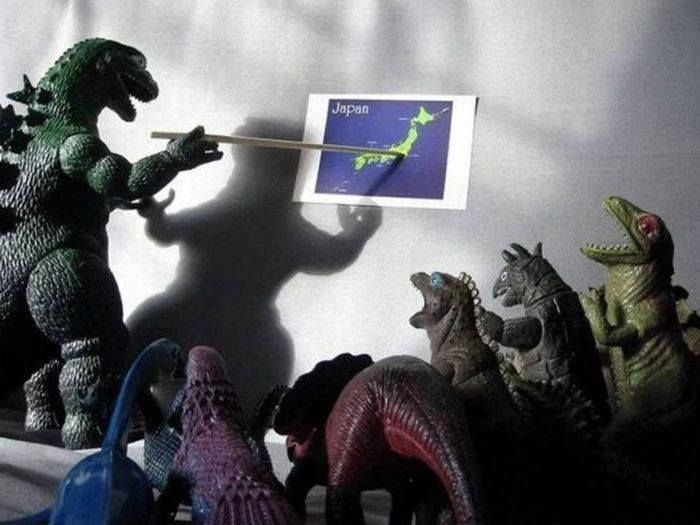

- Find organized team sport? Could be fun, but, ummmm…. This is me trying to play soccer….

Yeeeaahhh….

I really don’t have a body fit for contact sports. I break easily. Even so, I’d be willing to try something non-competitive. Unfortunately, there are no community team sport activities out here in the boonies where I live, at least not that I know of. I will look out for any.

- Return to my pricey boutique fitness studio. I want to give this another chance. This time I will try to be smarter about it. This is a small gym that I was going to regularly and really liking for a little while last year. I stopped going because I burned out and injured myself. This time, instead of going there 4+ times per week, I will initially go only 1 or 2 times per week and will keep aware that I’m not pushing myself too hard. Easier said than done, but worth a try. I will pay on a per visit basis instead of monthly membership so I’m not tempted to go more often than I should.

- Workout in my room. I don’t have high hopes for sustaining this based on past experience, but I’ll give it another go.

THREE. Reduce Stress!: Get more sleep & Meditate

- My fitness tracker also measures my sleep. I have a long standing habit of staying up late and then getting up crazy early to go to work. (Not good and very stressful on the body.) I knew I wasn’t getting enough sleep, probably less than 5 hours per weeknight, but the tracker revealed the truth. I was only getting between 3-hrs,41-min and 4-hrs, 27-min per night of actual sleep. I’m making a concerted effort now to get to bed at an early hour so I can get a solid 7 hours each night. I’m using the new ‘Bedtime’ feature in my iPhone clock app.

- I’m also using a meditation app to help me wind down when I feel keyed up.

FOUR. Improve my diet.

I want to set realistic goals here, so I’m not promising to have anything close to a perfect diet, but this year l’m working on cutting down on the worst offenders for me (wheat/gluten, dairy, and sugar). Eating more high quality food will also cost $$$. I will need to recalculate how my monthly food/personal budget category will be impacted.

So I have my work cut out for me. Thankfully, I now have some money set aside so I don’t have to feel like I’m choosing between debt repayment and taking care of my health.

Are you struggling to stay (or get) healthy? What are you doing? Do you feel that it competes, financially, with your focus on getting out of debt?

.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)

A big congratulations on your progress. It wasn’t that long ago that you were on over $100,000. You’re pushing forward very quickly. Please bear in mind that once you are below about $30,000 it is more like carrying a handbag than a heavy rucksack. Best wishes.

Paul, London, UK.

LikeLike

Thanks, Paul! Yes, $30,000 will feel like child’s play. My credit card debt was $30k, so that’s a debt level I’ve beaten before. Can’t wait to get there, though!

LikeLike

I am also over 40 and health is now a priority. I developed lower back pain recently, and am getting conflicting info from doctors and other health professionals. I get paid on an hourly basis, and the more I sit in an office chair, the worse my problem gets. I just can’t work the crazy hours I used to. Healing my back, managing my pain and losing weight have to be a priority this year, even if it costs me in terms of income. I think i the long term, focusing on health will reap benefits for you, financial and otherwise.

LikeLike

Yes, they call it the ‘sitting disease’. Working in a cubicle all day has done a number on my body. I can empathize. I agree. Once we develop health problems, we’ll either pay now or pay later. And paying later, will be a lot more expensive…

LikeLike

When I saw your number I thought, ‘wow she’s almost out of the 80s!’ And here you are thinking you’re pretty much still in the middle, lol!

I’m thinking about going to a spin class at the Y. It’s $8 per drop in, so I’m going to give that a try see if I like it. I find I need a classroom environment: something structured and other people present as witness to keep me motivated to not give up.

This was a fun read!

LikeLike

Yeah, I’m the same way about needing structure. I just live so far away from any gym. It’s a trek to get anywhere.

Lesson learned. When I have to move from where I am now, and I would have to be forced to leave this rent (!), I will look for places near a good gym!

LikeLike

I faithfully run 3 miles every other day. I’ve been listening to audio-books, podcasts, and/or Pandora. My food budget is my secret shame that I am working on. A popular farmers market moved/opened a few miles from me so that is helping me a lot this month.

LikeLike

I’m so impressed! I walk everywhere (no car) so I get some movement, but there is a limit to what my body will put up with. I get crazy foot pain when I walk too much over a stretch of days/weeks. I’m afraid of what would happen if I tried running. I’d still like to try, though. Join the club about the food budget! I gotta get that figured out.

LikeLiked by 1 person

Working to lose weight as well. I’m about 20-30 pounds more than I should be. I also have high cholesterol – it’s genetic. I’m at 250. More consistent exercise, and for me, less sugar. Consistency is of course key.

LikeLike

Yeah, I think some of my health issues are genetic too. Gah! The sugar habit is sooo hard to kick! That stuff is like heroin! (Hyperbole alert!)

I actually have more sympathy for people with various addictions. Hang in there!

LikeLiked by 1 person

So good you’re taking steps to take better care of yourself.

I usually don’t weigh myself and prefer it that way, but I’ve done it some lately and I have gained some weight. Just a little bit, so no biggie, but I want to nip it in the bud. I think it’s due to laziness in mealplanning etc (but that’s partly due to another kinda complicated factor which isn’t likely to be resolved anytime soon, so it’s not *just* a matter of discipline), so I don’t eat enough real, nourishing food and then I end up snacking and eating too much junk. And drinking too much alcohol to “handle” stress, if I’m honest. I’ll have to make some kind of progress on the meal planning thing.

Is your plan to keep putting $2,650 to your debt every month?

LikeLike

Yeah, this is the age where all those bad habits come back to bite us. Ouch!

Yes, my plan is to keep putting that much toward my student loans every month if I can swing it. This debt has to go.

LikeLike

I think I mentioned in my latest post that I just bought a rice cooker to make oatmeal in. Oatmeal is super cheap, and might help with your cholesterol. Smoothies with frozen fruit are also great, and don’t require too many fresh (expensive) ingredients.

LikeLike

Thanks! One of my projects this year will be to find less expensive yet healthy food that doesn’t require a lot of prep (kitchen) time.

LikeLike

I need to work on my health more as well. Thanks for the encouragement!

LikeLike

Glad my post helped. 🙂

LikeLike

Great job as usual on crushing the debt further. Your financial goals look entirely unachieveable to me, but I’m doing what I can. When I look back to my debt at this time last year, it was $6000 more than what it is now, and I really buckled down to pay extra. Pretty depressing that 12 months have gone by, and my shovel is still too small for any meaningful impact. Still, I crunched the numbers on my homemade debt tracker spreadsheet, and found that with some superposition of sacrifice and extra earnings, I can end my debt sentence in exactly 5 years from now (02/20/2022).

That said, you’ll see. $30-$35K of debt will feel more like an annoying rucksack. You could take a breather for a month, pay ONLY $1000 towards your loan, and indulge in something you’ve been wanting for years.

Re food/nutrition, I would look into the details of your choices and options. It is possible to feed yourself on something like a $300/month budget and get a decently healthy diet in. Plain yogurt, apples, tangerines, carrots, celery, wheat germ, raw almonds, broccoli, low fat cheese like fresh mozzarella, different beans, whole wheat bread, tuna, eggs (I would buy the expensive organic, hormone-free in this case), potatoes, brown rice.

Re gym, great if the setting motivates you, but even just a committed 20 minutes of strength training 5 days a week in your bedroom (push ups, planks, squats), along with 3-4 days of cardio (fast walk, bike, slow jog) should keep you in slim shape (below 24% fat percent).

I’m still dragging my feet on writing a blog, but one of these months. 🙂

Looking forward to your next update and rooting for success beyond expectations. You deserve it.

LikeLike

Wow. 02/20/2022 payoff date? Are you into numerology? I wonder if those numbers mean something. You are very right that there is inexpensive healthy food to be had that could cut down my expenses. This will be an ongoing project for me this year. And yes, working out at home is a possibility. I just need to try. Thanks for your rooting! 🙂

LikeLike

I’ve also been trying to work on healthy habits lately. Sitting at a computer for 40 hours a week (just for work! That doesn’t even include “personal” use!) is really taking a toll. I don’t know if this is an option, but I like to play Just Dance several times a week. You do need a gaming console (I bought mine for my partner for Christmas one year because he really wanted it, and he kept trying to get me into games so I could use it, too) and either a smart phone or an additional controller. I love it because I work up a sweat, get my heart rate up and can start or stop whenever I like. Also, I do it in the privacy of my living room which is nice because I look ridiculous trying to dance (I have no natural ability.) Obviously, I wouldn’t suggest running out to buy a console just to do this, but if you already have one and like listening to stupid pop songs this is a fun way to exercise without it feeling like exercise.

LikeLike

I do have a console! Back when I had my own apartment, I used to play a few dance and sports games for physical activity. And I did work up a sweat. It was fun! Now, though, my room is so small, I assumed it wouldn’t work. That and jumping up and down on the squeaky floorboards might annoy my roommates. Not to mention the sound through the thin walls. But I’ll give it a try (maybe with headphones? lol) and see what happens. Ugh, I miss having my own place.

LikeLike

Hi. I didn’t read all the comments, but everything you said resonated with me so much that I felt compelled to leave you a comment about the weight. I’m now 44, and for the last several years, I’ve been holding on to about 10 extra pounds, and this last year I finally “grew” out of most my work clothes – EXPENSIVE!!! Somehow, I came across Bright Line Eating (google it, you’ll find it quickly, I’m sure) and waited until something I could afford was offered, which was the 14 day challenge. I lost 9 pounds, fit in my old clothes (wish I gave away fewer!!) and feel much better. (And I’m sticking with the food plan.) Oh, and she has a book, Happy Thin and Free, coming out in March, but I thought the videos with the 14 day plan were invaluable. As for the exercise, I can’t recommend pilates enough (for back pain in my case). I would imagine there are videos on youtube – I do a local mat class for $11 a class 1-2 times a week. Anyway, I’m also still knocking out my student loan debt myself, found you through J.Money, and applaud all your efforts. Great blog, and I wish you all the best!! 🙂

LikeLike

Thanks, Nicole! Welcome!

I’ll take a look at them. I know that I really need yoga and/or pilates. I definitely have the sitting disease. Weight gain, back pain, high cholesterol, etc. Death by Cubicle won’t be far behind unless I start taking care of my body. I hadn’t thought about watching exercise videos on Youtube for some reason. I’ll look into it!

LikeLike

It can definitely be hard to balance health issues with trying to tackle debt issues. I started trying to tackle both last year and the costs of the health issues definitely slowed down my progress, but I am still heading in the right direction. I think you are smart to have many small, quantifiable goals in these realms. Good luck!

LikeLike

Thanks. Good to hear that things are improving for you. I’m bracing myself for the cost of the all the tests my doctor wants to run. But I think it will be worth it. I’d rather spend money on tests now if it helps to cut down on how much I have to spend on medications later.

LikeLike

DDSW, when you get your bloodwork done, you may want to get your iron tested, hemoglobin and ferritin. Sounds like some of the health issues you are complaining about may be symptoms of low iron. Also, you might want to check out Classical Stretch by Miranda Esmonde White if you have pain issues. It’s very gentle and might be a good place to start your at home workouts.

I think you are doing great on your money goals. I thought you were almost in the 70s when I saw that number!

LikeLike

Thanks, Cynthia. My doctor is running 1,001 tests and iron/ferritin is included. I should know more in the coming weeks.

LikeLike