It is that time of year again. Check out my past reviews:

- 2014 Year in Debt – I still want to be the ‘umm, no’ cat in that post when I grow up.🙂

- 2015 Year in Debt – What an emotional and financial roller coaster! It was a year of health and job loss scares.

In 2016, I started off the year with worthy goals and lots of optimism. In January, I got hit with a $750 bill for short term disability over-payment because my employer hadn’t calculated taxes properly following my surgery in 2015. Next, I paid off the last bit of medical related credit card debt and was now credit card debt free AGAIN. In February, I had a temporary panic about potentially losing my cheap (for this area) rented room. Panic is the right word, given that so much of my potential to make progress on this debt hinges on my ability to continue paying below market rent for my room.

By March, I focused my attention on my student loan debt. As the Spring season began, my first action was to refinance my federal loans (6%+ average interest) to private loans (3.4%). For a six-figure loan balance, this change started reducing my yearly accrued interest by thousands of dollars. This monthly savings in interest, helped me to get traction with my huge payments.

The trials of renting a room and living with roommates flared up again and I was worried about needing to move for safety reasons. I dejectedly decided that the cheap rent was worth the risk. I also reaffirmed how much I hated debt and the choices it forces you to make. I really regret this debt. I often deal with stress by planning, so I also did some (financial) Spring cleaning (or attempted to).

By June, the sun was shining bright, and the weather was warm, so I decided to improve my health. Stress has been causing me health problems ever since I started tackling my financial problems. I started working out and feeling good about it, all things considered. I finally dropped below the $100,000 water mark for my student loan debt. It was good to slip below six figures of debt. I had a couple of setbacks, financially and healthwise. I had to stop working out.

By Autumn, I was at a crossroads again about whether to focus more on saving for retirement vs paying down student loan debt. The highlight of the year was my much anticipated international trip, which was wonderful!! ::screams:: Omg, I LOVED it. If I didn’t have this debt, I’d be living over there now. I HATE debt!

As the year comes to a close, an emotionally exhausting presidential election cycle FINALLY ended. America learned that who you vote for (or not voting at all) matters. I learned that startups aren’t for me, at least not in my current financial situation. I HATE debt! On the bright side, I learned that I will be getting a promotion and raise at work starting next year. I’m not getting my hopes up about what the amount of the raise will be, but every little bit counts.

And lastly, to wrap up the year, I managed to reach another debt milestone.

Alright. Enough of the stroll down memory lane. It’s time for some cold, hard, numbers. I tally the outcomes of my 2016 financial goals.

.

2016 Goals & Outcomes:

- ONE – Pay down my student loan debt from $111,336 to $90,000. PASS!

“Yeah, this may be crazy ambitious. But, hey, go big or go home, right? Paying this down will take even more than it appears on the surface. Remember in addition to the reduction in principal indicated above, I will additionally be paying thousands in interest over the course of the year. It will be a great feeling to be in five figures of debt instead of six figures of debt.”

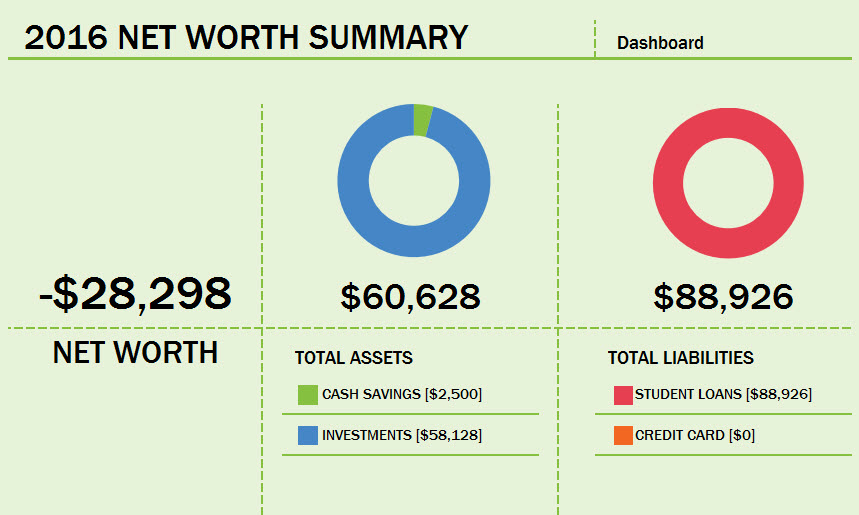

I did it! My current balance is now $88,926, even lower than my goal amount. When 2016 started, I didn’t think I’d actually be able to accomplish this, but I did. Refinancing to a lower interest rate helped a lot!

- TWO – Pay off remaining credit card debt of $1,996 and remain credit card debt free. Partial PASS

“I want this infernal walking dead credit card debt gone for good. I want to put bars and locks on its coffin so that it doesn’t crawl out and ensnare me yet again.”

I paid off that last $2,000, but did not remain credit card debt-free for the remainder of the year. I racked up some travel and health related debt later in the year, but paid it off again. So, 2016 ends with $0 in credit card debt.

THREE – Save $3,000 in an emergency fund. FAIL

“I eventually want to build up to a solid $6,000 emergency fund in the not too distant future, but for this year I think $3,000 may actually be attainable.”

I did build up an emergency fund of over $3,500 earlier in the year, but had to dip into that to pay off the credit card debt that I incurred both before and during my trip. I currently have about $2,500 in my e-fund, which is too low for me to feel comfortable with.

FOUR – Save $2,500 cash to pay for an international trip. PASS!

“What?! Yes, this has been a wish of mine for years, and travel is very important to me. It’s going to happen this year. It has to. … One thing that I promised myself right before my surgery was that if I came through it healthy and whole, that I would start traveling again, because life is too short. So I’m going to make it happen. I hope this will be the first of many yearly trips to distant locations.”

I saved the money and took my trip!! It was, by far, the highlight of the year!!! The very, very small downside was that I went over budget, but I have two words to say to that… WORTH. IT!!!

.

2016 Net Worth Review

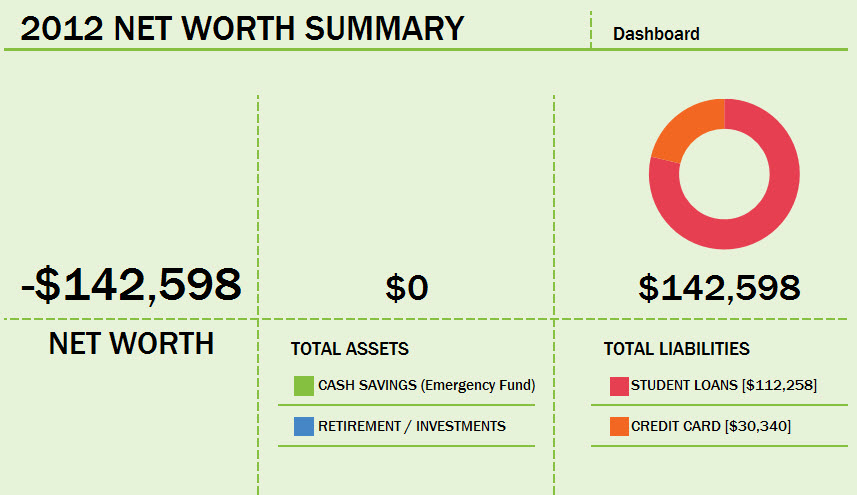

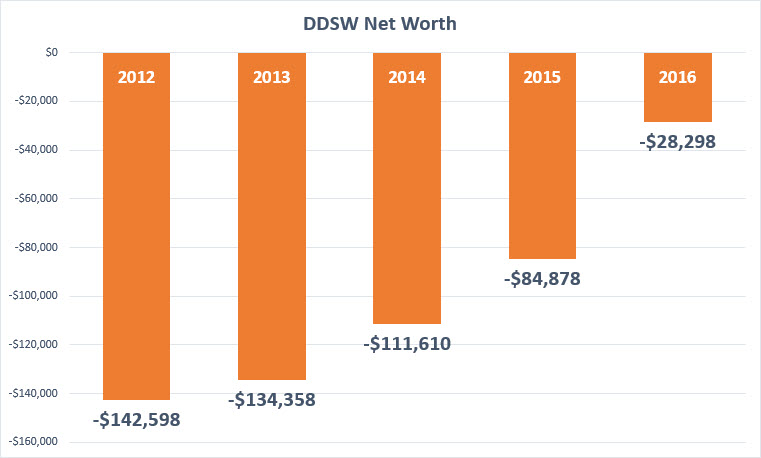

When I started this blog back at the end of 2012, my finances were at their worst.

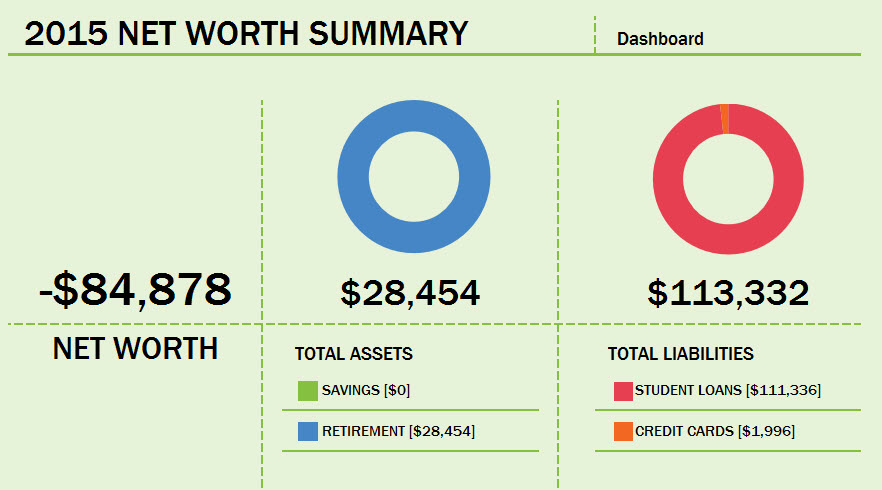

By the end of 2015, I’d made good progress despite a rather slow start.

One year later, at the end of 2016, I can now finally see the start of a shift in my finances.

*These are the final 2016 numbers as of December 31. (Updated Jan 1, 2017)

My net worth increased by $56,580 in 2016. That’s almost as much as it increased between 2012 and 2015 ($57,720)! The key to this has been keeping my living expenses low (e.g. having roommates, not having a car, etc), a record breaking stock market, and saving thousands of dollars in interest costs by refinancing my debt. Back when I had $30,000 in credit card debt, the high interest rate made paying it off feel like trying to climb out of quicksand. This year, I also managed to stay out of the hospital, and unlike last year, did not accrue any medical debt.

My assets calculation does not include any money in my checking account or in any of my sinking funds (e.g. opportunity fund, health fund), because those are meant to sink down to zero through the year. They are in fact, pretty much near zero now. I have also included my HSA within my investments category as most of it is invested (index funds).

.

Overall Grade for 2016: B+

I’m giving myself a grade of ‘B+’. I met almost all of my goals including one that I didn’t expect to. There was great growth in my net worth. However, this year I failed one goal (emergency fund), resorted to credit cards again during the year when my money was low, and I still feel like I’m not putting enough toward retirement.

Overall, though, I’m very pleased with the direction my finances have taken this year. 🙂

In my next post, I’ll look forward and lay out my 2017 goals.

Thanks to those of you who wrote in and shared your own personal experiences or offered advice over the year. Thanks to those of you who stopped by simply to read. Everyone sing along… Peace out, 2016!

.

.Click on my tagline below to see links to all my posts on one page.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)

Yey! Well done an excellent progress 🙂 I’ve been following your blog for over a year now and please know I am routing for you all the way over here in Scotland! (You’re on my to do list if I ever win the lottery 😉 ) All the best for the new year and keep up the good work, you’ll be debt free and FREE before you know it!

Susan

xx

LikeLike

Thanks, Susan! I can only continue to chip away at this debt mountain. Extra positive vibes coming your way for you to win the lottery! ha! 🙂

LikeLike

Wonderful!!! You are my current financial hero. I am still in law school and racking up debt. But I will follow your lead the second I graduate this May. You’ve been really inspiring. Thanks for sharing all your stories.

LikeLike

Thanks, Lawrunner! I wouldn’t wish six figures of student on my worst enemy. … Well, ok, maybe I would on my WORST enemy, 👿 , but no one else! I wish you the best of luck with fighting your own debt beast.

LikeLike

Congrats on an amazing increase in net worth in 2016! I know you give yourself a B+, but I’d give you an A!

LikeLike

Thanks, Jena! I was surprised to see that my net worth had changed as much as it did. I tend to focus on my debt almost exclusively. Doing this calculation annually, is helping me keep in mind that I’m not only making sacrifices to send money away to a lender, but that when this is over I’ll have the start of a little something saved for myself too.

LikeLiked by 1 person

It is great that you are able to multitask and do both!

LikeLike

Wow, fantastic job this year! I’m so glad you had that international trip too. When you get that student loan beast down in the $50,000 range, it will be downhill from there. You will feel like you are in the land of the living! Best wishes in 2017. Keep fighting the good fight.

LikeLike

Yeah! I’m so glad I got to take the trip. Things are moving in the right direction. Thanks, Isabella.

LikeLike

Truly wonderful job this year. That’s a massive net worth shift! And even more dramatic if you look back to 2012. Can’t wait to see what you do in 2017.

LikeLike

Thanks, C! I’m hoping that nothing drastic happens next year and we all make it through in one piece.

LikeLike

I’m so glad 2016 was a good year for you! Is the living situation going ok, all things considered?

LikeLike

Thanks, Maria. I am overdue for a housing update…

LikeLike

Amazing! At this rate you’ll be in positive net worth halfway through 2017! That in itself will be a huge psychological boost.

LikeLike

Yes. Reaching any milestone is a boost these days! 🙂

LikeLike

Wow! Good for you. $114,185 worth of progress in 4 years! That’s wonderful. Keep up the great work. You got this!

LikeLike

Thanks, Cynthia!

LikeLike

You did an awesome job! BRAVO!

LikeLike

Thank you!

LikeLike

Holy cow! You’ve accomplished so much this year!

LikeLike

Thanks 🙂

LikeLike

Congratulations! You’ve been so inspirational! I never really started blogging my journey as you suggested but maybe this year will bring that change! Best wishes for 2017!

LikeLike

Thank you! Good. I look forward to seeing more about your financial journey. Ah, we all start somewhere. And congrats on the new whip!

LikeLike

Wow this is amazing! Look at those changes! I can’t imagine increasing my net worth $50,000 in a year!

LikeLike

I was surprised, too! I made a number of changes and all those efforts added up. Oh, and the stock market had good returns last year. It all helped.

LikeLike

I’m just now catching up on blogs. WELL DONE! You are a QUEEN! I’m so impressed at your 2016!

LikeLike

Aww, thanks, Katie! I wish I had a crown made of gold…so I could sell it and pay off this blasted debt! 🙂

LikeLike