My Hazy Retirement Goals

In my last post -Part 1– I wrote about my back and forth struggle between allocating money toward debt payoff vs retirement savings. Hmm. What are my retirement goals? I’ll have to dedicate a separate post to this another time, because I haven’t thought it through yet. I only have hazy visions.

I’d like to marry rich and retire instantly. Ha. Wouldn’t we all, right? Short of a miracle like that, I’d like to plan to keep working for another 10 years in my industry at maximum salary and maximum savings. Around the age of 50 (or whenever I get laid off and can’t find more work or get burned out beyond repair), I’d like to go into ‘working retirement’ (financial freedom) for another 10 years until 60 or so.

This will be work that I want to do and think is enjoyable regardless of salary. It would have MUCH lower stress and likely much lower pay, but would be enough to pay for all the extras and fun things. This may be part time work or contract work where I can work 6 months on/ 6 months off and travel or rest for half the year. Or maybe run a small side business. Who knows. It will be fun to imagine the possibilities.

I don’t expect I’ll travel much after 60. I’ll likely be ready to nest somewhere. C @ theSingleDollar has also started thinking about retirement living options for singletons. I would love to find a cool retirement community, maybe like the one shown above.

In this vision, seniors in the community participate in gardening and growing their own vegetables, getting exercise and socializing while generating income. In its current incarnation, the design for Home Farm has the capability to grow 35 tons of green leafy vegetables every year, and those produce could potentially generate up to $6 million dollars (USD) in sales for the for-profit venture. The vegetables would be grown through vertical aquaponic farming and rooftop soil plantings. (Seedstock.com)

It’s just in the concept phase, but sounds cool. and looks gorgeous. Why can’t we build retirement communities in the US that look like that!?

What I’m Doing about It

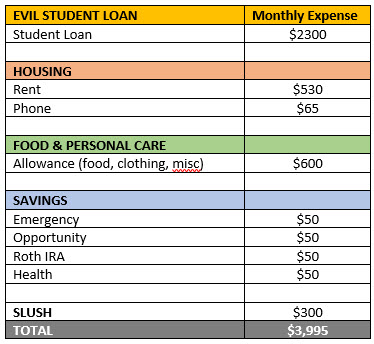

My income has not changed. My new plan is simply to better structure the extra money I have left over after making the minimum payment on my student loans. Instead of making haphazard extra payments of varying sizes, I’ve decided to allocate more of that money to retirement savings. This is just a start, of course. Here is a great article to learn more: What to Do When You’re 40 and Have Nothing Saved for Retirement (Lifehacker.com)

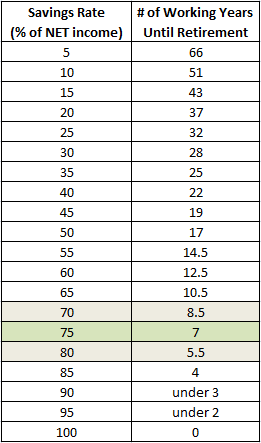

I know it’s not much compared to the 75%+ that we’re supposed to save in order to FIRE, but it’s a start. Because I’m taxed so heavily, the increase didn’t affect my net pay as much as I thought it would. Any pay raises or cost of living adjustments that I get will go toward increasing retirement savings. Once my student loan debt is paid off I will have a better shot at saving half my income (or more)!

I’ve been reluctant to pursue this because of health concerns, but I will take a look at what I can do. It will have to be just the right job. I don’t have a strong constitution in my current state. I’m already stressed out and have all the chronic health issues to show for it (high blood pressure, high cholesterol, headaches, migraines, neck and back pain).

Of course, anything I come up with will only be a first estimate, but even a ballpark figure will be helpful.

Good for you for making a desicion! I must admit it was satisfying to see you slay your debt, but 2300 a month is still a lot! How much of that is interest rate?

I hope you can make use of your cheap rent for a good while longer. 🙂

LikeLike

Yes, Maria, it is a lot! Ugh! I just think of all the things I could be doing with that money! Arrrgghh!

But, if I want to be out of debt in under 4 years, that’s what it’s going to take. I don’t want this debt around my neck ten or fifteen years from now!

I pay about $300 in interest every month, so IF (big IF) I can keep this payment up, I’ll be cutting my debt down by $2k every month. I don’t know yet if this will be sustainable, but I’ll try anything. Indeed, this payment strategy hinges on my being able to keep this cheap rent for as long as possible. Fingers crossed.

LikeLike

Oh, I’d almost forgotten my retirement options post! I think I am still thinking along those same lines though. Maximizing community, minimizing loneliness and likelihood of ending up institutionalized. I think it can be done pretty cheaply. My present standard of living is fine by me — a room of my own in a group house — so maybe I’ll just do that forever! It is a little depressing to think that I’m nearly 38 and have less than $40K invested, but it’s better than nothing (which is what it was three years ago.) Meanwhile, you’ve knocked another $3000 off your loan if I’m doing the math right. Onward!

LikeLike

Yeah, I don’t want to end up in a soulless institution. I want to be around people and have community, but still have my privacy and solitude at the end of the day. I’d like to have my own apartment (1BR or studio) in a retirement building/compound/neighborhood/something. Shared social spaces, activities, health care, but with my own unit to live in. I guess I’m just done with roommates. I’m glad your situation suits you. You’ll have little difficulty adjusting to just about any retirement situation. I like living around people, just not with them. LOL.

Yeah, I hear you about the low retirement savings. I’m older than you and that’s about where I am – plus all my debt. So cheer up. It could be worse. 😦 🙂

I feel like I’m swimming in mud. My balance feels like it hasn’t moved in 6 months. LOL But yes, ONWARD!!

LikeLike

Invest in your health and hobbies before taking up a second job again – what is the point of paying of all that debt if you don’t have your health or any enjoyment in life?

LikeLike

Agreed. I’ve spent some time thinking about the value of getting a low paid/minimum wage type job. (Not allowed to get a second job in my field per my employment contract.) After taxes and added stress and wear and tear on my body, extra commuting expenses would it be worth it?

I looked into some part-time jobs, local and online. I even sent in one application. The hourly rates sounded not too bad on the surface, but when you looked at the time involved (esp online jobs), it just wasn’t worth it. I’m not opposed to the idea of getting a second job, just skeptical at this point. I should try to be more strategic. I’m giving more thought to spending time laying groundwork for starting my own business in the future.

LikeLike

Hello Denise, how’s everything with you? I thought I wrote a reply to this post a while back, could be I didn’t. :S

Anyway, your plan sounds good. 🙂 I admit it was satisfying to see you slaying your student loans, but you’ll be still making good progress with your new plan. Would you mind sharing how much of the 2300 goes to interest?

LikeLike

You DID reply. I didn’t see it because I wasn’t getting notifications anymore. Oops. I replied to your earlier post. 🙂

I think my notifications should be working again. Thanks for checking in.

LikeLike

Hey…everything ok with you? I hope so!

LikeLike

Ha! I’m fine. 🙂

A while back, I made some changes to my phone which unknowingly caused me to stop getting WordPress notifications. I assumed that no one was commenting! I thought you guys all went away. “I’ve killed them! I’ve finally bored them all literally to death”, I thought. lol I’ll post an update within the next week! 🙂

LikeLike

“I will raise my monthly payment from $2035 to $2300 and will keep it there for the time being to free up cash.” How will raising your SL payment, “free up cash”? Wouldn’t a higher payment take more money?

LikeLike

Ah yes. I see how that could be confusing. I had been paying $2035 as my monthly automatic payment. In addition, I paid varying amounts of money above that, whatever I had on hand. My payments totaled more than $2300 per month. I raised the minimum payment to a set $2300 (now $3210) and any extra money will now go elsewhere. Did that help or is it clear as mud? 🙂

LikeLike

Now *I*’m confused. :p Is the minimum payment now $3210? :S

LikeLike

Ha! No. No. The minimum is around $2000. (5 yr loan term) I’m paying $2300 now.

LikeLike

Oof. If I paid on a ten year plan, I would need to pay $1600 a month. I’m currently paying 25% of that. Some day things will change. But is not today.

LikeLike

Yes, I hear you. I’m trying to pay as much as I can now. I don’t know what my situation will be next year. At any time my landlord could finally decide to stop landlording and kick us all out. (I’m still hearing rumblings about the possibility.) If that happens my rent shoots way up and my debt payments go down. I have to make hay while the sun shines and adjust if that changes. Don’t feel too down about your payment schedule. You have plans in the works with your business. Once your income goes up your repayment time will shorten a lot.

But I’m not going sugar coat it. Debt sucks. Hang in there.

LikeLiked by 1 person