A Shift in Strategy

Once I killed my credit card debt and could focus on my student loan debt, my intention was to throw every spare dollar I had at it, to the exclusion of everything else. I planned to keep my retirement savings down to 5% to get my employer match. Lately, I’ve been reconsidering that position.

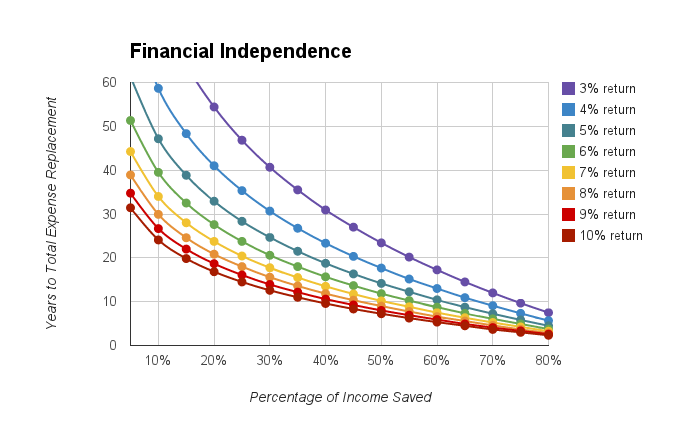

I ran across the Early Retirement Savings chart again while perusing other PF articles. I even wrote about it here. The more I looked at the numbers, the more I realized that the longer I put off retirement savings, the older I will be before I can reach financial freedom (working retirement).

You can recover lost money, but you can’t get back lost time, so I need to get back in the game. I’ve been conflicted for forever about how to balance retirement savings and debt payoff.

Articles in the personal finance sphere say different things. Some say pay off all debt first because it reduces risk and provides a big psychological boost. Others say prioritize retirement savings to take advantage of compounding interest over time or to catch up with your savings if you are already older. Yet others recommend simply allocating money 50/50 or some other combination. FS-DAIR recommends setting your priority as a function of interest rate. How confusing. There is no wonder why there are so many articles about this.

Of course, everyone’s situation is different, hence my endeavor to find the solution that is best for me. I’m not in my 20s with $18,000 of student loan debt. I’m in my 40s with $97,000+ of student loan debt. I’m woefully behind in my retirement savings. I have a little north of $40k, when a person my age should have hundreds of thousands saved already.

The Center for Retirement Research at Boston College estimates that workers who start saving at age 25 need to set aside 15% of their annual income throughout their career to accumulate enough for retirement, while those who start when they’re 45 need to save 44% of their annual income going forward to save the same amount. (Learnvest – An Easy Way to Get Started with Retirement Saving)

Yeah, that will pretty much be my life for as long as I can work. It feels like these shackles will never come off.

With no savings at 45, you’ll need to accumulate $1,698 in your portfolio every month to meet this goal. If you have $50,000 set aside for retirement, your monthly contribution will be only $1,298. With $100,000, a 45 year old can likely start retirement with $1 million by saving $861 per month. (Consumerism Commentary – How to Save a Million Dollars at Any Age)

This second quote looks more palatable at first glance, except that there are two assumptions therein that I can’t bank on…

Take Care with Assumptions

First, most retirement planners and even the two quotes above assume we want and need 1 million dollars. Do I? Do you? If you are married with a close family network, live simply and don’t foresee any serious illnesses in your future, you may do well on less. If you foresee a high risk of serious illness (see nursing home costs!) or other obligations, you may need more. Visit Mr. Money Mustache’s site to learn more about retiring on less than a million dollars.

Second, we can’t assume we’ll be able to work at maximum salary until 65 or beyond! I remember when I was at my old job, we had a retirement savings rep come by to speak with us individually. One of the few things I remember about that conversation is asking what the minimum contribution was and blithely telling her when she asked when I planned to retire, “Oh, until 70! Forever!’ I may have said that I didn’t expect to be able to retire. Oh, how times have changed! Five years later, I have a more realistic vision of retirement planning. We don’t always choose when we retire anymore. Sometimes it’s foisted upon us.

Moreover, long life and health is not guaranteed to any of us. I know of two people who fell seriously ill immediately after retiring in their 60s/70s. They were expecting a full healthy retirement of travel and leisure, but instead were hit with a major medical diagnosis. One died within a year. The other is almost home bound and can’t easily travel anymore.

A while ago, I read a great piece from the LA Times called Too Poor To Retire And Too Young To Die. Its profile included a ‘Gray Nomad’, a woman who lives in her old RV, driving from temporary gig to temporary gig, who lives precariously close to the edge financially. When reading this I felt worried for her. What happens when her health fails? What happens when that RV breaks down for good? Yikes. It could happen to anyone, especially nowadays in the post pension era, with so many of us having so little saved. With the looming likelihood of no spouse and children of my own I can’t help but wonder… What will happen to me?

.

Stay tuned for Part 2 (my next post) where I share what my retirement goals are (broadly at least) and what shifts I’m trying in my spending to get me closer to them.

.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW) [All posts on one page]

I think either strategy (go all-out paying off debt for at least a year, or direct something towards retirement too) is actually fine — I mostly just think you should pick one and commit to stick with it for at least six months, not because changing your mind is bad but because constantly worrying about it is bad for your mental health 🙂 If you do want to change to direct more to retirement, you can send smaller amounts that way with very little impact on your debt repayment, because of not having to pay taxes on that money; your take-home pay won’t be impacted as much as all that.

LikeLike

Thanks, C. Yeah, I want to get to a point where I can set it and forget it. Right now i’m in the trial stage. It’s like a budget. The numbers never work out the first time you try. Can I handle putting more toward retirement? I may need to make adjustments until I’m comfortable that I’m not moving too aggressively. That seems to be a pattern of mine. But that’s the goal – find a good balance and then stop fiddling with it. 🙂

LikeLike

Hmmm… Based on my initial not-a-financial-expert-pretty-risk-averse-and-not-a-high-earner-hunch that my not at all be right for you in any case,

I think I’d:

1. look over my budget,

2. do some research on long term care insurance

3. see what other priorities I may feel strongly about for my money and/or my life (possibly: opportunity fund, growing the emergency fund, whatever)

4. looking over my budget again and deciding if you want to make some changes in regards to long term care insurance or other things that may be very important to me.

5. Do some calculations on the interests rate of paying down debt vs saving for retirement

6. Ponder what may be realistic for me in how I function emotionally.

7. Look over the budget again with eyes that have in mind my reflections/discoveries

8. Deciding on “allocationg money 50/50 or some other combination” based on the insights gained in the previous steps.

Easier said than done for sure. But you do what works for you!

LikeLike

Hey! Did you get a sneak peek of my Part 2 post already? 🙃

LikeLike

Hihi! Maybe I could make good money as a psychic. 🙂

LikeLike

Speaking of retirement, what do people think of annuities? I have a blog post on retirement annuities here: https://krystalbrownblog.wordpress.com/2016/08/22/saving-for-retirement-regardless-of-your-current-age/

LikeLike

I haven’t heard good things about annuities in general, so I haven’t looked at them in detail. Thanks for sharing.

LikeLiked by 1 person

I struggle with this, too. I’m in my early thirties and my girlfriend has not yet agreed to marry me, but I have nearly $150K of educational debt and $10K in an IRA. I’ve decided to focus on retirement savings for now because of the beauty of compounding. I also don’t know what sort of changes will happen to student loan repayment options. It is possible that things could change in my favor.

However, I have reason to believe that I can double my income soon due to a skill I’ve been developing. Once that happens, I’ll try to kill 1/3 of the student loan debt quickly because I want to be able to buy a small condo and get away from these terrible roommates and need to fix my DTI.

LikeLike

Hey, what is your girlfriend waiting around for? 🙂

Yeah, I’m so torn between cleaning up the past and getting these shackles off vs. having financial security in the future. All I can do right now is a little bit of both and hope for the best.

Being able to double your income sounds great. I really hope it works out for you. I know what 150k in debt is like. I know what having terrible roommates is like. Let’s just say that I would not wish either on anyone.

I know you’re feeling uncertain about your mentor. Trust your gut. Take time and do more background research on him before committing to any business arrangements.

LikeLike

Great post! I’m contributing in my 401k up to the match and not anything more while paying off my student loan. This way I get a double psychological boost of taking that principal balance lower and seeing my retirement grow.

Compare student loan APR to avg investment return after taxes. I would lean toward the debt maybe 75% and the other money in retirement. That way you build some momentum. If you do qualify for a Roth IRA maybe max that out each year since you can’t make up for lost time there. Once you have the student loan gone you will have a huge increase in cash flow. If there are other things you can do now to free up more of your hard earned cash do it. Downsizing transportation, living arrangements, selling things you don’t use etc.

Becoming self employed is one way to fight off ageism in the workplace. You also have a bit more long term security in the end. Working for a company does have its share of pros / cons. I always like to look at the math.

Last but not least don’t compare to others too long . It can be a great motivator yes but also add to feelings of remorse. You’re a debt fighting monster right now and can do this! Good luck! 🙂

LikeLike

One of the reasons I have become self-employed is because I have personally experienced ageism and seen it happen to so many others who are depending on others to hire them.

LikeLike

Yes! Agreed. I think self-employment will end up in my future on way or another. Once you hit 50, things get very dicey on the job market. 😦

LikeLike

Yes, good points. I do want that debt gone. At the same time there are benefits to putting at least some money toward retirement, even though it is not risk-free. I get taxed rather heavily (single, no dependents, no property, no tax breaks), so my 401(k) contributions makes the most use of my money today (tax-deferred). If I go all in on the debt, I’m making payments with net income and having to watch a bigger chunk of money go up in smoke, I mean taxes. Sigh. There is no perfect solution. I need to find the balance that is right for me right now (50-50? 60-40? 27.4-72.6?) and adjust as my situation changes. It will take a little time to see what is sustainable.

Yes, I am keeping self-employment in mind as an option. In fact, for people like me who are starting late with saving and investing, it may be a necessity. I’ve spent a little time thinking about the possibilities here.

Thanks for the encouraging words!

LikeLike

My vote is to stay focused on paying off the debt. You don’t want to retire with debt. Once that is paid off, your savings will be enormous and grow by leaps and bounds because you have learned how to keep your spending well under what your earn. Eye on the prize DDSW!

LikeLike

Don’t worry, I’m not going to stop paying down my debt!

Ha! At this rate, I don’t ever be able to retire, so retiring with debt won’t be an option. 🙂

But yes, I agree. I do NOT want to retire with debt. No way!

LikeLike

I am in a similar position to yours, although my student loan debt is now around $42k (down from $105k), after graduating law school over 10 years ago. I focused on paying down the student debt, but now find that I only have about $25k saved in retirement (I’m self-employed, so no free money via employer match). The interest rate on my remaining student loan balance is pretty low, much lower than what the markets are returning right now, so I’ve decided I will focus on saving and contributing to my SEP-IRA. I also do not have a fully funded emergency fund. I’ve got enough to last about 3 months, but that is not enough when you’re self-employed, I think. Ideally I would have a full year of expenses saved up, as I also have no short or long term disability insurance at the moment. That low retirement balance is really frightening me these days. My difficult decision right now is whether to shore up my emergency fund first, then start focusing on retirement, or just immediately invest 20% of my gross and think of it as an extra “tax” so that I don’t see it and just budget savings and everything else with what is left.

LikeLike

Good point. There are undoubtedly consequences any approach. Because you are self employed and don’t have disability insurance or other benefits, I’d suggest that you spend time focusing on building up an emergency fund of at least 6 months. I fell ill last year and after a trip to the hospital emergency room learned that I needed major surgery. Without those benefits, I don’t know what I would have done. That’s just my view. I don’t mean 100% or nothing. You’ll need to find the % balance between the two that works for you and let’s you sleep reasonably well at night. I know the feeling…

The good news is that SEP-IRA’s allow for much larger retirement contributions than 401(k) right? You can put in over $50k every year! Once you are out of debt you can catch up quickly with your retirement savings, especially as your income grows.

Hmmm. Another reason for me to look into self-employment in the future.

LikeLike