Kill it with fire!

My student loan refinance has gone through and the balance on my previous student loan servicer’s account is now $0.00! I’ve logged in at least 4 times since that wonderful event, just to look at the zeros. Somehow I bet that it is normal to do that. 🙂

I was worried that I would end up with my own crazy-making servicer payoff story when trying to get them out of my life forever. Unsurprisingly, they were super slow in processing the payoff check, probably to rack up the last bit of interest, but they didn’t try any other tricks. Goodbye old servicer! *Waves goodbye*

Now that my student loan debt is situated in its new (servicer) abode, it’s time to burn said abode to the ground!

To adapt the words of singer poet Ellie Goulding:

Strike the match, play it loud, giving love to the world

I’ll be raising my hands, shining up to the sky

‘Cause I got the fire, fire, fire

Yeah I got the fire, fire, fireAnd I’m gonna let it burn, burn, burn, burn

I’m gonna let it burn, burn, burn, burn

Gonna let it burn, burn, burn, burn

I’m gonna let it burn, burn, burn, burn

What does being in six figures of debt feel like?

It feels something like this looks…

The weight, the tension, the stress; it’s all there. Always knowing that I’m one mistake away from being crushed by it… It blocks out the sky. It takes up an over-sized amount of space in my life. Six figure debt is so big that it has its own gravitational field. It controls or influences everything around it, including me. And…it has to go.

My First Payment

Who is actually ever excited to make a student loan payment? I am! I could have waited a little longer to make my first payment, but I just couldn’t wait and watch interest acrue. Plus, I didn’t want to be this guy…

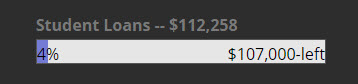

My first payment was $3,716. This brings my balance down to $107,000. Unfortunately, I won’t be able to make payments this large on a regular basis. This payment was a combination of tax refund and good old paycheck money.

Losing Interest?

I guesstimate that I have nearly halved my monthly interest payment from $600+ to $300+ thanks to both the lower interest rate and to my plan to make payments semi-monthly, which supposedly may help to save money on interest as well.

.

Anyone Else?

Anyone else out there in mega debt? Grab your matches and join me!

We’re gonna let it burn!

.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)

Hey, that’s awesome! It’s pretty cool that you were able to use your tax refund to make your first major payment a really serious one. It’s actually not going to be that long until you’re only in five figures of debt 🙂

LikeLike

I know! It was good timing. Yes, I can’t wait to get down to five figures.

LikeLike

Congrats on the first payment! I’m trying to pay down debt at a rapid pace as well! Good luck and I’ll be reading. 🙂

LikeLike

Best of luck with your debt payoff as well. You are very fortunate to have a partner who is on the same page with you about money. That’s half the battle. Yes, let’s cheer each other on!

LikeLike

Great job, DDSW, you’re going to beat this. I know very intimately how debt (and near zero margin of error/slip-up) feels, and my little celebration today is that with the auto-payment that went through on my Navient account, I now owe (in thousands of $$- 38.637) less than my age (in years – 38.642). It’s a silly milestone, but my day is brighter in result.

My rent is going up as of the month of June, and I still don’t have a daytime job, so my ‘debt shovel’ is weak (per the sorry fire extinguisher picture), and until the job opens up, it’s going to be minimum payment + $30-$50. So, 11 years, 4 months at that rate. 😦 Anyway, I’m hopeful that I’ll get a more powerful shovel. One can only downsize in expenditures/minimalism so much with a school-aged kid.

Keep plugging, but don’t forget small, meaningful rewards. We none of us know if we’ll be alive in 10 years.

LikeLike

Thanks. Congrats on owing less than your age. I hope you did something to celebrate the milestone. It sounds like you could start your own blog about everything your dealing with. I hope things turn around soon for you.

LikeLike

Did you by any chance use MeetEarnest as your refinancer? I just looked today and the rates went down about 1% for me since the last time I did a soft check (before it was only 0.3% different from my current rate). I’m now leaning towards refinancing. I ask because I would love to support you by using your referral link if you have one. I’ve heard that its $200-$300 bonus? Please email me if you have one available!

LikeLike

That’s a nice drop in interest! I sent you an email.

If anyone has an Earnest referral link, let me know and I can pass it along to Angie.

LikeLike

I just refinanced this morning. For so long I was doing quotes and getting near the same rate. But Earnest was able to drop my rate from 3.53 to 2.37% on my private student loan. Thanks for reminding me to look into it again. Its a minor amount saved for me but with no out of pocket costs (other than a hard credit pull) it was a no-brainer to refinance.

LikeLike

Awesome! Great rate 👍

LikeLike

Yay! I’m excited for you! I paid down debt with my refund as well and it felt good!!! I am so glad I found your blog, you’ve inspired me to really tackle my monstrous debt. Thanks for sharing and keep posting!

LikeLike

Thanks, Carolyn. I appreciate the kind words. We’re in this together.

LikeLike

Woohoo, yes! Saving around 300 dollars in rent each month. Wow. That’s great.

LikeLike

Sorry, I meant interest, not rent.

LikeLike

Yes, it is wonderful. I’m glad I was encouraged to reconsider refinancing. It has been a big help.

LikeLike

I think that’s amazing and that interest saving will cut your time to freedom in half almost $300 less interest a month is a large chunk what ever way you look at it. Go you debt killing singleton! burn that debt down!

LikeLike

Ahhh yes. Debt has a special way of making a normal person become obsessed with destruction. Thanks!

LikeLike