Yes, I decided to refinance my student loans. Wait! Put down your pitchforks and hear me out!

- Have I lost my mind? Maybe…

- What was I thinking?! Well… It seemed like a good idea at the time…

A Second Look at Student Loan Refinancing

You guys are great! I appreciate your supportive comments and suggestions. Thanks to blonderbetterfasterstronger and reader Angie, for reminding me that refinancing may be an option for me after all. I’d read a number of complaints and stories online about applicants getting rejected left and right by these newer loan start-ups. I assumed that because of my high debt to income ratio, I would be unlikely to get the opportunity to refinance my student loan debt any time soon.

I decided to take a second look around to see if I qualified for anything. I requested rates from a few lenders that appear to have the best reputations in the marketplace for student loan refinancing. I was pleasantly surprised that I wasn’t outright rejected by any of them. I took a look at what they had to offer and decided to accept one.

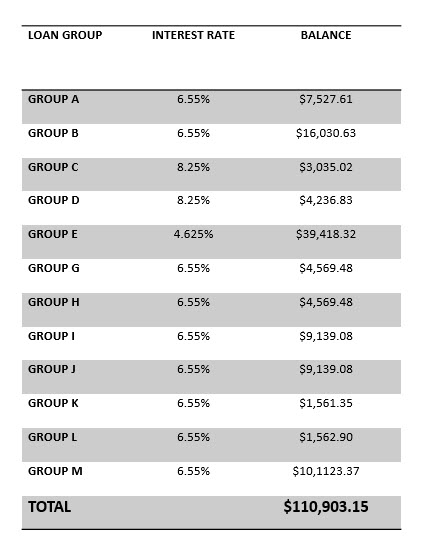

That long list of loans that we’ve all come to know and hate since my last post will be going away soon. That’s right. This list below…

… will be replaced with this…

I’m actually excited that I qualified to lower my interest rate. It’s nowhere close to the lender’s lowest rate, but it’s a fair sight better than the rates I have been paying up until now. I’m not complaining. I’ll take what I can get. Undoubtedly, paying off all that credit card debt first helped me out.

Why Did I Re-finance My Student Loans?

There are a number of risks involved in re-financing federal loans to private. Frankly, it is not the right move for most borrowers. So, why do it? Simply put, for my situation, the risks were outweighed by the potential rewards.

ONE. The new interest rate is significantly lower. The sheer size of my six-figure balance magnifies the benefit to any interest rate reduction. This should help me get more traction on paying more of the principal.

TWO. Paying down one loan is more convenient than paying down 12. There are more chances for something to go wrong when a servicer is managing several loans. It’s less stressful to have one loan, and the fewer number of outstanding loans reportedly helps your credit score. I really don’t care about my credit score as I don’t plan to ever go into debt again, but a good score does help with renting an apartment, employment background checks, and perhaps qualifying for an even lower interest rate on this student loan once I pay down a good bit of the balance.

THREE. I don’t need any of the federal forgiveness programs. No way in hell am I keeping this loan around my neck for 20 years to try to get it forgiven. I don’t have the desire or the skill set to pursue a public service career for any length of time, let alone be forced to stay in it for 10 years, etc.

FOUR. This loan is not immortal. My new lender offers some basic protections that private student loan lenders haven’t traditionally offered in the past. In the event of death or disability, the loan will be discharged, just like with federal loans.

FIVE. The new loan has a pause button and options. If I lose my job or become ill, the lender will pause my payments for three months at a time, up to a total of 12 months. If my financial situation changes for better or worse, I can refinance with my new lender or elsewhere.

SIX. Most importantly, I plan to pay this debt off quickly (in under 5 years). This is my only debt, and I have ‘relatively’ good job security; about as much as you can have these days anyway. I don’t plan on making any big career changes any time soon. What I do plan on is killing this debt with fire!

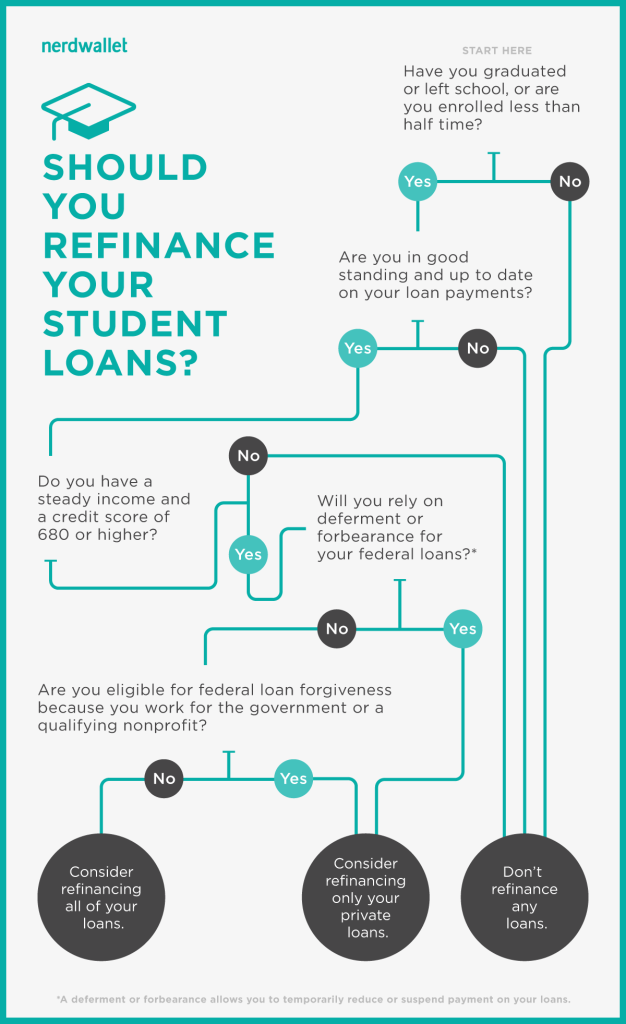

Should You Refinance Your Student Loans?

I can’t answer that of course, but there are some good sources out there to help you decide. Here is an infographic from Nerdwallet in an article about student loan refinancing. Google is your friend.

You can get more info here about student loans and refinancing options.

So What Now?

Once things are set up, I can start making payments. I’ll keep you updated on how things go. We’ll find out if my decision was crazy great or just crazy…

I can’t wait to see the balance go down on this debt. Every time I get frustrated with something money related, which seems often these days, I resolve that I will kill this student loan.

“Kill it! Kill it with fire!”

.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)

I know next to nothing about refinancing student loans (I’m not from the States, I hope that’s relevant and that things work differently in my neck of the woods because if not I’m too ignorant for my own good, lol), so I’m not even sure why I should feel the need to raise my pithcfork. :p Some kind of increased risk that you wouldn’t otherwise have, it seems.

…but from what you write, it sounds like a good deal to me! That lower interest rate must go such a long way! 🙂 This will be very exciting, I do hope you’ll keep us updated (but of course, only do it if you want to, you shouldn’t do it if it increases your stress). 🙂

LikeLike

Thank you. You are very fortunate not to have to deal with student loans and refinancing or even to have to know about it. Glad to know there will be one less pitchfork. 😄

LikeLike

Oh I do have some student loans (and more are probably in my future, but I’ll be very cautios). But I think my country provides reasonable-ish federal loans to such an extent that refinancing them isn’t much of a thing here.

What I find odd here is that so many people say that student loans are such a beneficial loan so you shouldn’t pay them off early. Wtf?! They’re probably better than credit card loans, but if you have to pay interest it’s better to just pay them off quicklyif you can and be free of them. But when I say that people often look at me as if I’ve misunderstood something, but honestly, I think this is the kind of thing where I’m right and “everybody” else is wrong. That does happen sometimes. :p It could be that if I invested money smartly I would get a higher return than the interest of the student loans, but that’s not for me at this point, and I doubt many of my peers are that savvy either.

I like C from the Singledollar’s suggestion: “I think you should keep a running total and post it with your debt updates: “Interest I would have paid under the old rates” vs “interest I’ve actually paid.”

LikeLike

Yeah, I agree about paying student loans. I say just get rid of the debt and be done with it once and for all. We can only make decisions for ourselves, for better or for worse. Please be very cautious with student loans in the future. Learn from my mistakes. Avoid them if at all possible.

LikeLike

Seems like a well reasoned move. I think you covered all of the bases.

item 4 as I understand it is not real common, most private loans survive death/disability.

Most important is your 6th point. That you plan to pay off the debt quickly as you can.

It doesnt sound as though this pertains to you, but Dave Ramsey talks a lot about how refinancing doesnt really ‘pay off the loan’. Its fine to do, but he always cautions people from thinking they have done something when they refinance. Its making the extra payments that matters when tackling debt.

A great first step for you would be to at minimum keep making the same payment that you currently are making. That would be an extra couple hundred dollars a month on the loan.

Congrats, look forward to hearing about when you have it paid off!!!

LikeLike

Thanks, I will be looking forward to paying it off as well! In my case, with the large amount of debt I have, lowering the interest rate will save me thousands of dollars in interest on top of paying it down quickly. For some people in certain situations, refinancing can be helpful.

LikeLike

I think this is a fantastic move. You are going to save *so much* in interest. In fact, I think you should keep a running total and post it with your debt updates: “Interest I would have paid under the old rates” vs “interest I’ve actually paid.”

The only possible downside for me is that killing smaller loans is more fun and feels more manageable, what the snowball technique is designed to take advantage of. I suggest you come up with some way to simulate that — maybe keep track of when each of the old loans WOULD have been paid off (=principal paid down is equal to the size of one of the old loans) and have a little ceremony.

Congrats on getting this through! It’ll be hugely less stressful and complex, and save you lots of money in the long run.

LikeLike

Thanks, C.

Yes, I’m thinking of ways to mark the milestones as I pay it down to keep it interesting.

Yeah, I’ll try to find a way to calculate total interest saved. It’s a little complicated because the two loans are different payment schedule types with different timelines so it’s not a 1:1 comparison. Nevertheless, I can come up with some basic numbers.

LikeLike

I love C@thesingledollar and am avid reader of her blog (and yours), but I disagree with her (and George H. Puck) on this point. I think Dave Ramsey’s advice is really only helpful for people just starting out with debt repayment or for people who have struggled to stick to a debt repayment payoff plan who need the psychological ‘wins’ associated with paying off debts. You know those people… People who are contemplating whether or not they are prepared to make the real sacrifices necessary to get out of debt. I don’t think that is DDSW’s case at all. She has consistently made the sacrifices necessary to get out of debt AND demonstrated her ability to comeback from setbacks both medical and financial. As you have steady employment and an enormous loan, I think this was absolutely the a great move. You are going to save a ridiculous amount in interest.

Like most, I believe that having smaller goals in your debt repayment plan is a good idea. The first goal might be to get to $100,000 or $99,999.00. But that is like with any goal (weight-loss, learning objectives, etc.) I just don’t see the benefit of tracking what the interest on the old loans would be as you had multiple loans and would have had to recalculate interest every time you made a massive principal payment. Ugh, that sounds like so much work for little reward. I mean obviously it is totally up to you but this reader will certainly be tuning into your debt repayment updates whether you do that or not.

In any instance, CON-GRAT-U-LATIONS!!! This was a serious achievement on your path to become debt free.

LikeLike

Thank you for the encouragement, Candice. I will definitely have milestones set up to celebrate just as I did when paying off my credit card debt. Having those near-term goals helped to keep me motivated. This will be no different. Yes, going from six figure debt down to five figures will naturally be one of those markers!

LikeLike

That’s an amazing rate! Is it fixed or variable? Either way, if it’s variable, I’d be surprised if the rate gets close to what your old rates were in the next five years!

I was thinking about re-refinancing mine to a shorter term/lower rate, but I think I’m pausing my accelerated student loan repayment, in favor of paying extra on my mortgage for a few months, and refinancing that instead–right now my mortgage rate is higher than my student loan rate! Congrats on the refinance!

LikeLike

It is variable. I agree. I’m not concerned about interest rates rising. No one expects the Fed to raise rates very much this year. It would take over two or three years of regular raises before the interest rate could get to my old level. By then, I will have paid off enough that I could refinance again to lower the rate back down.

LikeLike

Fantastic new rate. I too am curious if it is fixed or variable.

LikeLike

Thank you! It is variable, but I have no concerns about that being an issue for my loan term.

LikeLike

Yay this is awesome. It will make such a difference with extra payments paying off principal rather than interest! I agree with a variable interest rate for a 5 year payoff. Rates are expected to stay constant or have minimal increases for this year (maybe 0.25%-0.50%). Then even if it raises 0.25% a quarter until payoff in 5 years you should still come out ahead.

LikeLike

Thanks! That’s the plan.

LikeLike

I’m finally getting to the point in my life where I can look at my student loans without crying or hiding from them- and reading your blog from the start has bolstered my courage.

LikeLike

Thank you and keep going. 🙂

LikeLike