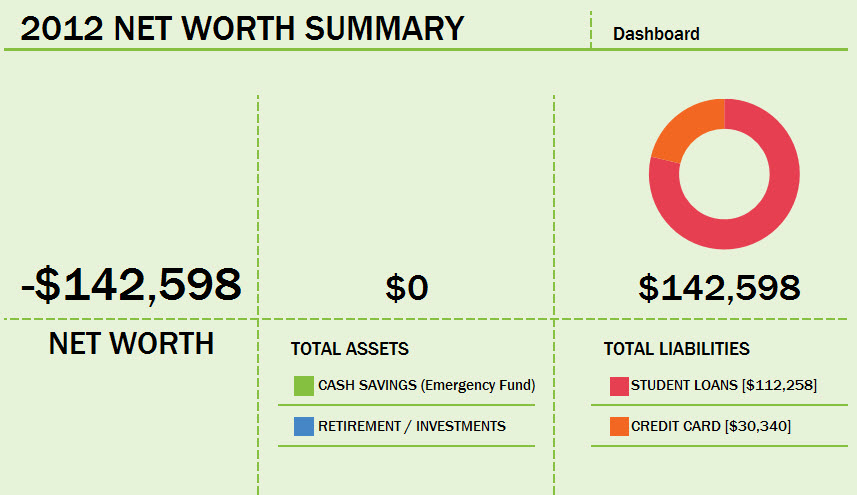

I began this blog in the Winter of 2012 and at that time I had a six figure negative net worth. I had no assets. My financial picture was entirely comprised of liabilities. I had been completely oblivious to the financial dire straits I’d put myself into until that point in my life. My student loans were coming off of forbearance and there was no way I could afford the minimum payments. It was game over. In January of 2013, I gave up my studio apartment, sold or gave away almost everything except my clothes and books and moved into a rented room.

End of 2012 Net Worth: -$142,598

I lost my job in the Spring of 2013 and spent the next four months unemployed. Imagine having this much debt, no job and no partner to lean on. My stress levels were off the chart. That’s when life finally got real. I vowed to kill this debt or die trying. I eventually got a job in another state and here I’ve been ever since. Despite some financial setbacks, I’ve made progress toward turning around my finances.

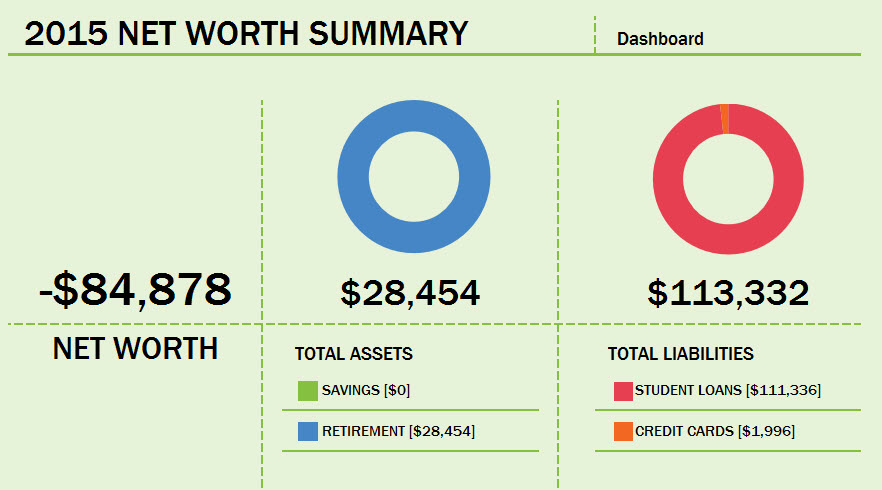

End of 2015 Net Worth: -$84,878

Wow! Things are moving in the right direction. I may be $85k in the red now, but with hard work and determination, I’ll be flat broke in no time. Yeah, I’m actually looking forward to having a $0 net worth.

.

DOUBLE DEBT SINGLE WOMAN GOALS FOR 2016

ONE – Pay down my student loan debt from $111,336 to $90,000.

Yeah, this may be crazy ambitious. But, hey, go big or go home, right? Paying this down will take even more than it appears on the surface. Remember in addition to the reduction in principal indicated above, I will additionally be paying thousands in interest over the course of the year. It will be a great feeling to be in five figures of debt instead of six figures of debt.

TWO – Pay off remaining credit card debt of $1,996 and remain credit card debt free.

I want this infernal walking dead credit card debt gone for good. I want to put bars and locks on its coffin so that it doesn’t crawl out and ensnare me yet again.

THREE – Save $3,000 in an emergency fund.

I eventually want to build up to a solid $6,000 emergency fund in the not too distant future, but for this year I think $3,000 may actually be attainable.

FOUR – Save $2,500 cash to pay for an international trip.

What?! Yes, this has been a wish of mine for years, and travel is very important to me. It’s going to happen this year. It has to. As you may remember, I have a family member who is currently living abroad in a land far away. I have an open invitation to visit!

One thing that I promised myself right before my surgery was that if I came through it healthy and whole, that I would start traveling again, because life is too short. So I’m going to make it happen. I hope this will be the first of many yearly trips to distant locations.

.

That’s about it. I don’t have any specific goals around retirement savings this year, although I will continue to make contributions. I’ll set up a monthly budget in a future post…once I figure out how I’m going to accomplish all this. 🙂

What are your financial goals for 2016?

.

.Click on my tagline below to see links to all my posts on one page.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)

Wow! That’s a LOT of progress in three years! I hope you feel better seeing those numbers! 😀

LikeLike

Yes, I do! It helps a lot for me to keep an eye on the big picture, especially when I feel impatient that my student loan debt isn’t going down. Thanks, Maria. 😊

LikeLike

That really is a ton of progress, especially considering the disruptions you’ve faced — job loss, moving, health issues. Fingers crossed for a relatively un-bumpy 2016 which will allow you to make your goals, especially digging into the student loan debt.

LikeLike

Thanks, C! Agreed. 🙂

LikeLike

That really is a ton of progress, especially considering the disruptions you’ve faced — job loss, moving, health issues. Fingers crossed for a relatively un-bumpy 2016 which will allow you to make your goals, especially digging into the student loan debt.

LikeLike

You are super inspirational!!! I’m really excited to get out of debt as well! Your posts really put things in perspective for me and it’s nice to know it’s possible to accomplish these debt free goals with perseverance and determination! Keep the awesome posts coming, and best of luck this year!!!! You can do it!

LikeLike

Thank you for the encouragement, Eri! 😊

LikeLike

Yes, definitely the most inspirational and well written blog I’ve read since I started seeking people in similar situation to my own. That said, my situation is in some ways less encumbering, and in others more constraining than the OP’s. I’m a 38 year old single mom with a 9 year old. This puts breaks on my compulsion to live in my car, shower at a nearby YMCA, and travel wherever the best jobs are in order to kill off my debt in the shortest possible amount of time.

I have an engineering degree from a branded university, and was $76K in the hole when I graduated with my Masters in 2004. My career cannot take off as fast as it did for my peers (particularly the male contingent) who can live, breathe, and eat their job because unlike them I have to come back to my kid and be a parent, even if for 1.5 hours a day. As such, I am among the first on a chopping block whenever the projects dry up, and have been drifting from contract to contract in hopes of something sticking.

I’ve been paying my student loans regularly (after a two year stint with forebearances and sporadic payments during pregnancy and maternity leave) since August 2007, and I am now down to $38,800 between two loans – a subsidized $25K and an unsubsidized $13.8K, My minimum monthly payment for the loan is under $280 (quite manageable), but at that rate, I’ll be 51 when I make the last payment. In the past 12 months, I’ve been paying extra on the loan as much as possible, but the amounts have ranged from $20 – $70, maybe $100 extra. I got laid off in January of 2016, and have been looking for a new job since, while collecting unemployment and doing private tutoring on the side.

My parents live overseas, and while they can hold their own financially, are in no position to help me out. I on my end, would be utterly humiliated to reduce myself to being bailed out by my parents at the age when I am in my prime energy and wisdom-wise. My sister is a doctor, and married to a doctor. They live the good life, and she is quite generous with presents to my kid, but I feel it unfair to ask her for an interest-free 36 month loan of near $40K, when she just got her own loans from medical school decimated to a last sum of low-interest amount, and is now throwing most of her paycheck into the condo she and her husband bought. My ex (not my kid’s dad, but the guy I was with before that – in college) wrote me a bail-out check for the loans last month, but I cannot in good conscience cash it, especially knowing that I am only 80% or so confident that I can repay him on the terms that would be in my esteem fair. Also, the amount he wrote to me exceeds the amount considered non-taxable gift, so that would be another hassle he’d have to deal with in tax reporting even if I reimbursed him for the incurred taxes. So, yeah, I’m going to do this on my own, one dollar at a time.

I’ve not had credit card debt, as I’m not a big shopper. It is unethical and environmentally irresponsible to not be critical about material possessions that one needs. I have a good amount of designer brands for clothes, but only because my fashionista rich sister passes them on to me, and my fitness regime keeps me slim enough to fit into her garments. I myself would not even know where to obtain such luxury items, nor do I have an interest in researching this matter further.

I have a car because I live in the city (and do not plan to move, as my kid would lose her spot in the selective enrollment public school she finally got into after three years of testing and hoping something opens up) and I work in the suburbs. I hate driving and commuting (understatement), and I even more hate contributing to the fossil fuel dependence of this country’s population and having such a high carbon footprint. I long to be debt free so that I can have greater choices in job selection (or working odd jobs while looking for that suitable fit).

So my goals for 2016 are to maintain my sanity and health to the extent that enables me to continue being a present and engaged parent, as well as staying free of credit card debt. Succeeding there, and I hold myself to a high degree of accountability on this, I plan to obtain employment that will enable me to pay off $2000 of my subsidized loan, and $6000 of my unsubsidized loan come NYE 2016/17. I also plan to run a sub-4:00 marathon before I’m 40. Given my last week’s quarter marathon time, I have a tentative chance. 🙂

That was my story. I hope we can stay cyber pals for the long haul. I wish everyone most of luck and success.

LikeLike

Wow. Yes, debt is a pain. It can even be difficult at times to watch others prosper while we struggle, but that is life.

Thanks for sharing your story. Hang in there. We can defeat this debt beast. Good for you to stay in shape and train for a marathon. My goal is a 5k at some point in the future. When? Who knows. Well you know what they say, goals without plans are just wishes. Keep us updated on how things are going for you.

LikeLike