It is that time of year again…

My 2014 Year in Debt post summed up the happenings of 2014. And I still want to be the ‘umm, no’ cat in that post when I grow up. 🙂

In 2015, I started off the year in high hopes. I was eagerly awaiting the grizzly end to my evil credit card. By the end of February, I’d paid off my credit card debt. $30k in credit card debt gone! I felt great about my accomplishment. Two weeks later, I landed in the emergency room. I had developed a health condition that could no longer be ignored. Several tests and doctors visits later, it was determined that major surgery would be required.

Before the surgery, there had been rumors and whispers about layoffs where I work. More and more signs appeared that something was in the works. I became worried that I might lose my job before I could get medical care. I wanted to kick myself for ending up in such a precarious situation. Finally, by late Spring, the axe fell. I survived the cuts and managed to keep my job and thankfully my health insurance.

I had some ups and downs during the Summer. Family can lay bare one’s insecurities in ways that strangers can’t. I had a scare that my rent would be increasing significantly, only to later find out that it would only increase a small amount, which made me very happy!

By Autumn, medical expenses in preparation for the surgery were pummeling my cash-flow and dragging me back into debt. However, surviving the surgery was most important, so I continued to keep financial goals on pause and try to think about other cheerful topics like being the broke single woman at work or feeling like I have nothing to show for all the effort I expended in my youth except a pile of debt.

After the surgery, I spent some time recovering. With the health emergency over, I’ve entered the Winter thinking yet again about the future and how I might take another job to make up for lost time.

Alright. Enough of the stroll down memory lane. It’s time for some cold, hard, numbers.

Last year, my 2015 Financial Goals post tallied the outcomes of my 2014 goals and laid out my 2015 goals.

Now, I tally the outcomes of my 2015 goals.

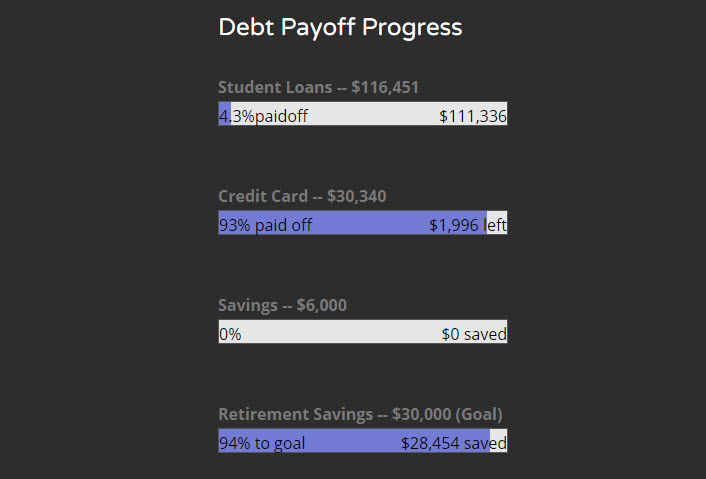

2015 Goals & Outcomes:

- Pay off remaining credit card debt of $5,990 — FAIL

- I paid off the remaining 2014 debt in March and then over the course of 2015 went back into debt.

- I’ve accrued about $15k in credit card debt this year, most of it related to my surgery, but the rest…not so much.

- I made a couple of final payments with hours left in the year and now have $1,996 in credit card debt to end 2015.

- Reach

$20,000$30,000 in retirement savings — WIN & FAIL- I had my retirement savings going full-throttle at the beginning of the year. I was able to meet my original goal of $20,000 saved. I then increased my goal around that point to $30,000. Not long after that, I fell ill and reduced my contribution to the point of my employer match in order to have access to more cash. This is where my contribution rate remains, plus an additional +1%.

- I currently have $28,454 in retirement savings, a tad shy of the $30k goal.

- Reduce student loan debt from $113,000 to $108,000 — FAIL

- Given my continuing issues with credit card debt, I haven’t been able to even think about my student loan debt. My small balance reduction has come from making minimum monthly payments.

- Like last year, I paid out over $7,000 in interest payments this year for the privilege of carrying that debt

- My current student loan balance is $111,336.

- Save $6,000 in emergency savings — FAIL

- I had $2,000 saved by March, but ended up having to spend it to cover the first of many medical bills from this year. I haven’t been able to keep money in this account all year.

- Pay cash for an international trip – FAIL

- No money or ability / health to take an international trip. Sigh.

Overall Grade for 2015: D

I gave myself a grade of ‘D’ instead of an ‘F’ only because of the progress that I made in increasing my retirement savings over last year. At the end of 2014 my net worth was (negative) -$113,131. At the end of 2015, my net worth is (negative) -$84,878. Not too shabby.

My flailing around this year hasn’t all been in vain. It’s not the end to 2015 that I was hoping for, but I’ll take what I can get. 🙂

I will lay out my 2016 and beyond goals soon. I can only do better than I did this year, I’m looking forward to that at least.

.

And finally…

Thanks to those of you who wrote in and shared your own personal experiences or offered advice over the year. Thanks to those of you who stopped by simply to read. Let’s raise our glasses in a toast. Goodbye, 2015.

.

.Click on my tagline below to see links to all my posts on one page.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)

“I paid out over $7,000 in interest payments this year for the privilege of carrying that debt” — *wincing*

I’ve had some long term health problems, so I had to drop out of my psychology studies. When I’ll (hopefully) be healthy enough to go back to uni, I would have to do five more years of pretty tough studies to become a licenced therapist (in my country, it’s a six year training and I finished the first year). Another possibility would be to finish two years of part-time studies that would help me get a job in an archive. I’m leaning towards the latter. The thought of five years as a poor and stressed out student AND ending up with a lot of loans aswell is hardly appealing. The stories I’ve read and heard about people struggling with their student (and as you know, it’s not just you!) have been very sobering.

Here’s to a better 2016! 🙂

Maria

LikeLike

Hi Maria! Yeah, you’re not the only one wincing at the amount of interest I have to pay for that blasted student loan debt. Ugh. You are smart to do the math of job markets and salaries vs student loan debt BEFORE you spend years in school. If only I had known then what I know now…

Agreed. Here’s to a better 2016! 🙂

LikeLike

Not too shabby at all. You’ve not only ended the year facing the right direction, which is half the battle, but have also been able to move along a bit. Just gotta keep going. Hoping for the best in the new year!

LikeLike

Would it make sense to use some of the retirement money to pay off credit cards and set up an emergency fund…then cut up all the cards and never use them again (go on a cash only system where you take out a few hundred dollars biweekly?). Credit cards are terrible, I just paid off $10,000 and it wasn’t pretty…never again!!

LikeLike

Hi, HK. I agree that credit cards are terrible. I don’t want to take any money out of my retirement fund (401K) because of the penalties that would be incurred. Not worth the trouble. For now, I plan to stick with the system that I have.

LikeLike