Long time, no write. I know 😦

I know the world has been curious about the machinations of ‘America’s Most Indebted Single Blogger’. Ha! I’m pretty sure I don’t hold that crown actually, but it feels like it sometimes.

I’ve updated my numbers and as you can see I have fallen back into credit card debt. Why? I have medical expenses not covered by my insurance and other expenses relating to my upcoming surgery. This debt may go up in the near future sadly. Doctors saw something in my pre-op scans that is potentially much more serious than what I’m having surgery for. Right now, there are two possible diagnoses; one is serious and life threatening, the other is significant, but manageable. If I have the serious condition, then having my planned (and very much needed) surgery will not be safe until this new condition is addressed… somehow.

So far I haven’t been able to get a definitive diagnosis. Because the serious condition is so rare, there aren’t many doctors that have sufficient experience with accurately diagnosing and treating it. I’m getting the runaround by doctors in my local area and can’t find someone with enough expertise. I may have to travel out of state to find an expert to get a proper diagnosis. As you can imagine, this will all cost money…

Back in March, right after I paid off my credit card debt I’d increased my savings rate and planned to build up an emergency fund before tackling my student loan debt. Instead, within days of breaking the shackles of credit card debt, I landed in the emergency room and a stream of medical expenses has chased me ever since. Financially, I’ve been treading water and starting to fall behind. Looking back, I wish I would have paid that emergency room bill with money from my HSA (health savings account) instead of paying cash as it depleted my little emergency fund and I haven’t been able to build it back since then.

I’ve decided to make some (drastic? sensible?) budgeting changes to get more cash in hand each month to pay down this debt and cover these ongoing medical expenses.

1. I am cutting my 401k contribution. Given my age, I’d started maxing out my 401k contribution in an attempt to start a hopeless race to catch up with my retirement contributions. I was already starting to enjoy the tax benefits and savings potential, but no longer. At this point, and I know this is a morbid thought, but given that there is a chance that I might not live to see retirement, this is no longer a top priority for me right now. I will reduce my contribution down to the point of my employer match.

2. I am stopping my Roth IRA contribution. I was also on track to max this out for the year. I’m stopping this contribution entirely.

3. I am reducing my HSA contribution. I was also on track to max this out for the year. I’ll reduce this to a trickle. I’m on the fence about how much to reduce it.

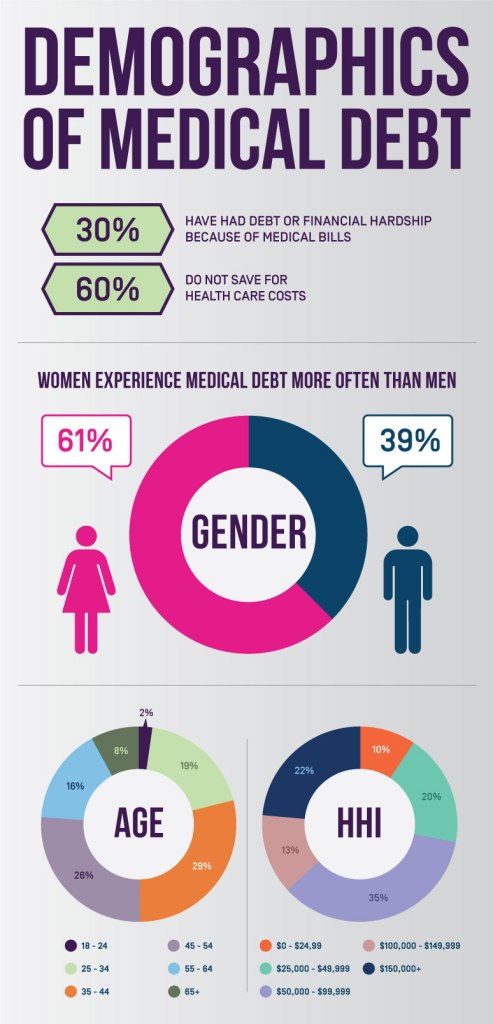

Image credit: spotlight.vitals.com

Depending on how this medical situation concludes, I hope to be able to moderately increase my retirement savings again at some point in the not too distant future. Once I see how my pay will be impacted, I will update my budget and start posting that more regularly. A personal finance blog should post about dollars and cents right?

In any event, my goals for the rest of 2015 are to survive any and all medical procedures with no complications, re-gain my health, pay off all medical and related debt, and re-build a full emergency fund.

“Debtor’s prison is real, and opportunity cost is a bitch.” (DDSW)

I hope it’s not the more serious condition.

LikeLike

So do I, Chica!! 🙂

LikeLike

Sometimes health comes before all else. I pray it will be the “easier” of the problems you mentioned. Maybe 2015 will just be a year to focus on health and the debts will start to reduce again next year.

Good luck.

Paul.

LikeLike

Yeah, I agree that the rest of the year will be focused on health and emergency money. Thanks, Paul. 🙂

LikeLike

I hate that your have to pay for your health. It just doesn’t seem fair… I am sending you good vibes to help get you through this!

LikeLike

Hi Amanda. I do have health insurance, but like most insurance, it doesn’t cover everything at 100%. Sigh. Thanks for the good vibes. 🙂

LikeLike

So sorry to hear about your health problems. I hope it is the less serious!

Please don’t forget that money is only a man made concept comprising of numbers on a screen and paper and metal. Your health and happiness is a million times more important. As I like to say, we’ll all be dead in 80 years so nothing is really that important. Seize the day!

Sending lots of love your way

LikeLike

Yes, health before wealth indeed. Thanks, Susan. 🙂

LikeLike

Oh man, this sucks so much! I really hope that you get an accurate diagnosis quickly and that there’s a reasonable treatment.

On the money…I’d stop worrying about the money so much for the moment. Honestly, a bankruptcy for medical debt would not be the worst thing for you. Your retirement accounts would be protected, as I understand it, and you don’t have other assets to seize. Pay the minimums on the student loans for now and just focus on your health itself; the money stuff can come later. Good luck!

LikeLike

Sound advice. I think that’s the plan for me for now. Thanks, C. 🙂

LikeLike

Lots of love.

LikeLike

Thanks, Katie. 🙂

LikeLike

Ugh! For what it’s worth, I think you are making sensible desicions, and I so hope it’s not the more serious condition. Sending you a hug!

LikeLike

Thanks, Maria. 🙂

LikeLike

Hope you’re doing ok, all things considered. Hang in there, lady!

LikeLike

I hope all is well with you and your health. I know you had an operation coming up. Best wishes for Christmas and into next year.

Paul, Croydon, England.

LikeLike

Thanks, Paul. I have mostly recovered from my surgery and am doing well.

LikeLike